- The GBP/TRY price remained stable after the latest interest rate decision by the CBRT and ahead of the upcoming UK retail sales data.

The GBP/TRY price remained stable after the latest interest rate decision by the CBRT and ahead of the upcoming UK retail sales data. The GBP to TRY pair is trading at 21.30, where it has been in the past few weeks. This price is almost 2% below its all-time high. The USD/TRY and EUR/TRY have also been nearing their all-time high.

The GBP/TRY price moved sideways after the Central Bank of the Republic of Turkey decided to leave interest rates unchanged despite the soaring inflation. The bank left interest rates stable at 14%, where they have been in the past few months. It also hinted that it will not tweak interest rates any time soon.

The relatively dovish tone happened even as recent data showed that Turkey was going through hyperinflation. The country’s headline consumer inflation surged to a multi-decade high of 73% as the cost of energy surged. The extremely weaker Turkish lira has also made the inflation situation worse by making it expensive to import oil and gas.

The next key catalyst for the GBP to TRY price will be the upcoming UK retail sales data. Analysts expect the data to show that the country’s retail sales dropped sharply in May this year. This decline will be because of the country’s soaring inflation. Data published on Wednesday revealed that UK inflation surged to 9.1% in May. This was the highest increase in four decades.

GBP/TRY forecast

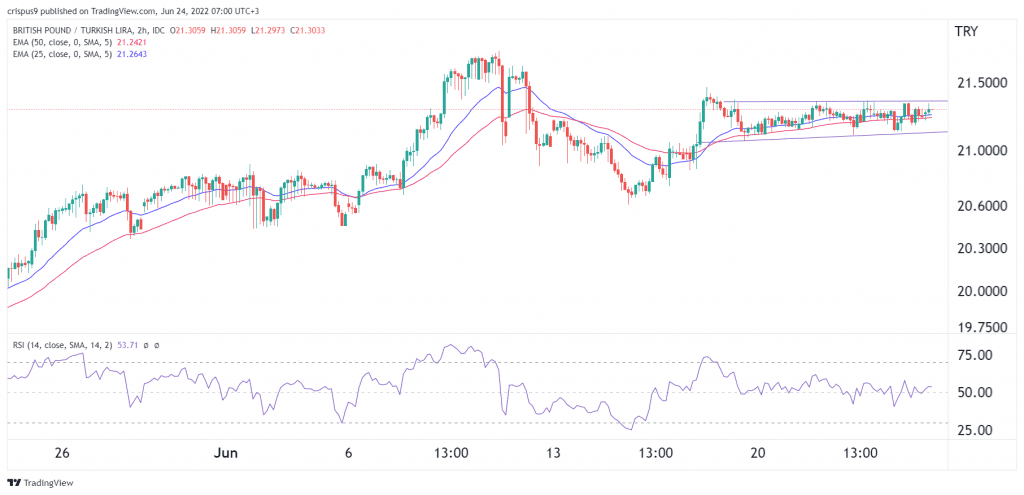

The two-hour chart shows that the GBP to TRY exchange rate has been in a tight range in the past few weeks. It is trading at 21.31, where it has been recently. As a result, it is consolidating slightly above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved sideways.

Therefore, the GBPTRY price will likely remain in this narrow range and then make a bullish breakout. That’s because of the divergence between the hawkish Bank of England and the dovish CBRT. If this breakout happens, the next key resistance level to watch will be at 21.50. A drop below 21.8 will invalidate the bullish view.