- The GBP/JPY price moved sideways after the relatively strong UK retail sales data published in Wednesday morning.

The GBP/JPY price moved sideways after the relatively strong UK retail sales data published in Wednesday morning. The GBP to JPY price is trading at 166.21, which is a few points above this week’s low of 164.70. It has risen by almost 4% from its lowest point this week.

BOE and BOJ divergence

The key driver for the GBP/JPY, USD/JPY, and EUR/JPY is the divergence between the Bank of Japan and other central banks. Unlike other central banks, the BOJ has found it more difficult to exit its easy-money monetary policies.

Instead, the bank has signaled that it will maintain interest rates at the negative level for a while. The BOJ has also said that it will continue making asset purchases in the coming months in a bid to keep government borrowing costs lower. Precisely, the BOJ has said that it will buy an unlimited amount of government bonds.

As a result, its balance sheet has expanded to over $8 trillion, which is bigger than Japan’s GDP. On the other hand, the Bank of England has hiked interest rates five times since December last year and there is a likelihood that it will deliver more increases this year. The BOE is fighting inflation, which has soared to the highest level in more than four decades.

Data published on Wednesday showed that UK retail sales rose from 3.1% in April to 3.6% in May even as the country’s inflation jumped. The data by the British Retail Consortium (BRC) differed from that of the Office of National Statistics (ONS).

The next key catalyst for the GBP/JPY pair will be the upcoming speech by Andrew Bailey. In it, he will likely point to what the bank will do in the upcoming meeting. The pair will also react to the planned strikes in the UK and the momentum of the Scottish independence vote.

GBP/JPY forecast

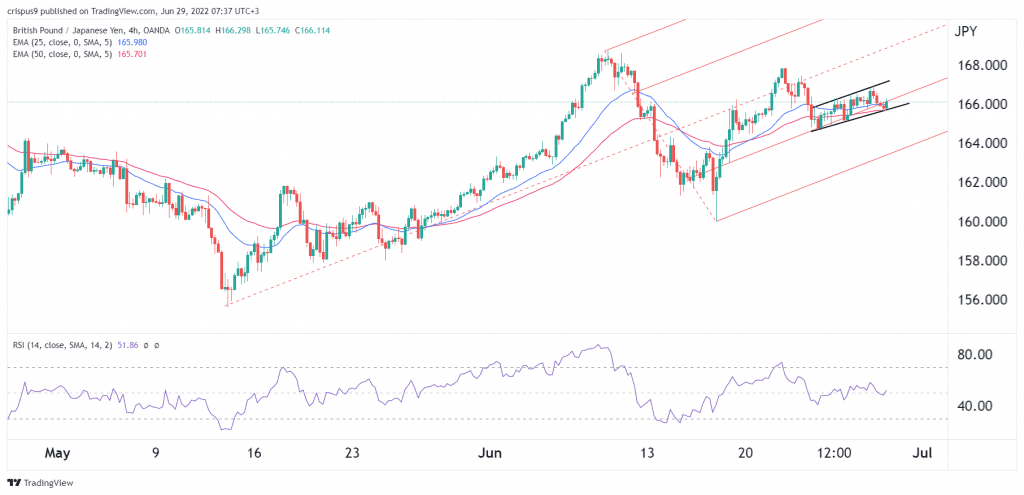

The four-hour chart shows that the GBP to JPY price has been in an upward trend in the past few days. It is consolidating along the 25-day and 50-day moving averages. At the same time, it has formed a small ascending channel pattern that is shown in black. Most importantly, the pair is along the first support of Andrews Pitchfork indicator.

Therefore, the short-term outlook is that the pair will remain in this range for a while. It wil then make a bearish breakout as sellers target the key support at 164. A move above the resistance at 167 will invalidate the bearish view.