The GBP/INR price crashed to the lowest level since July 6 of this year. It dropped as signs of more weakness in the UK economy emerged. The pair was trading at 94.01 on Tuesday morning, which was about 3.50% below the highest level this month.

UK and India’s economic divergence

India has emerged relatively well from the Covid-19 pandemic. Economists believe that the economy expanded by between 12.5% and 15% in the year’s first quarter. Moreover, its annual GDP growth is in excess of 7%, and analysts believe that it will grow by 7.2% in the 2022-2023 financial year.

India’s inflation has been relatively contained well because of the relatively low oil and natural gas prices. In addition, the country has taken advantage of the crisis in Ukraine to scoop cheap energy from Russia. As a result, analysts believe that the Reserve Bank of India (RBI) does not have the incentive to keep hiking interest rates.

The GBP/INR price has dropped because of the warning signs from the UK. According to Citigroup, the country’s inflation is set to soar to 18.6% in January next year. If this analysis is accurate, it will be the highest level in more than 50 years. The Bank of England sees inflation starting the year at 13%, while Goldman sees it at 15%. Either way, the situation is not looking good for the UK economy.

At the same time, the Office of National Statistics (ONS) decided to slash its GDP estimate for 2020. As a result, the UK economy is currently significantly smaller than where it was before the pandemic.

GBP/INR forecast

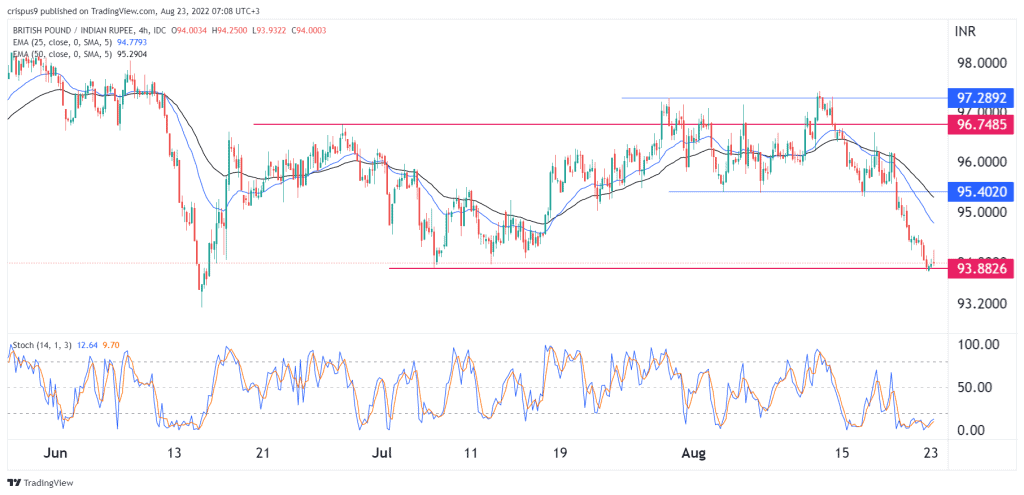

The four-hour chart shows that the GBP to INR exchange rate has been in a strong bearish trend in the past few days. This sell-off started when the pair formed a double-top pattern at about 97.28. It then accelerated after it moved below the neckline of this pattern at 95.40. As a result, the pair has dropped below the 25-day and 50-day moving averages and retested the lowest point on July 6.

Therefore, a break below this level will open the possibility of it falling to the next psychological level at 93. Conversely, a move above the resistance point at 94 will invalidate the bearish view.