The GBP/CAD price is in a downward trend ahead of the upcoming UK and Canadian GDP numbers. The GBP to CAD exchange rate is trading at 1.5635, the lowest it has been since June 16th of this year. It has fallen by over 2.47% from its highest point this month.

UK and Canada GDP data

The pound to CAD price has fallen in the past few days as investors focus on the converging sentiment between the Bank of England (BOE) and the Bank of Canada (BOC). With inflation in the two countries soaring, the two banks have decided to hike rates several times.

The BOE has increased rates in the past five straight months. And early this month, the BOC caught many investors off-guard when it hiked interest rates by 0.50%. Analysts believe the two banks will continue hiking interest rates in the coming months as it continues battling inflation.

The GBP/CAD has dropped because the UK economy is more vulnerable than Canada. The country’s inflation is higher than that in Canada, while labour strikes will have an impact on the economy. For example, Royal Mail workers are set to go on strike this summer.

The next key data to watch will be the final estimate of UK GDP data that will come in the morning session. Analysts expect the data to show that the country’s economy recovered in the first quarter as the government ended lockdowns. The data is expected to show that the economy expanded by 8.7% on a YoY basis. Still, analysts expect a sharp reversal to happen in Q2.

The GBP to CAD exchange rate will also react to the upcoming UK house price index (HPI) data Nationwide. With mortgage rates and inflation surging, analysts expect that home price growth moderated slightly in June. Canada will also publish its GDP data for April. Expectations are that the country’s economy expanded by 0.3% in April after rising by 0.7% in the previous March.

GBP/CAD forecast

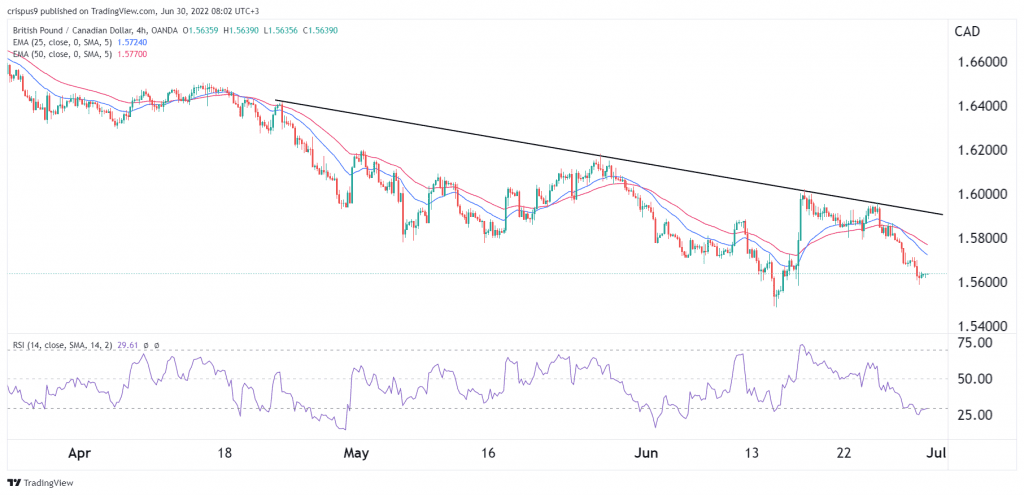

The four-hour chart shows that the GBPCAD price has been in a downward trend. It has struggled moving above the descending trendline shown in black. The pair has also moved below the 25-day and 50-day moving averages, while the Relative Strength Index (RSI) has moved to the oversold level.

Therefore, the pair will likely continue falling as bears target the key support level at 1.5500 in July. A move above the resistance at 1.5800 will invalidate the bearish view.