- The GameStop stock price has the potential to hit the $60 mark if the current support at $93 is taken out by the bears.

The GameStop stock price is trading lower in premarket, as are most of WallStreetBets meme stocks this Thursday. The GameStop stock price looks set for another lower open after falling 8.9% on Wednesday. Not even the news that Melvin Capital, the hedge fund that was hit hard by the WallStreetBets retail investors in 2021, was in the process of liquidation could prompt a celebratory pickup in price activity.

The fall in the GameStop stock price is directly related to the inflation-induced fall in big retail earnings. Walmart and Target reported worse-than-expected financials, sending the markets downward. These companies are a barometer for the retail sector, and weak earnings performances weighed heavily on the US markets.

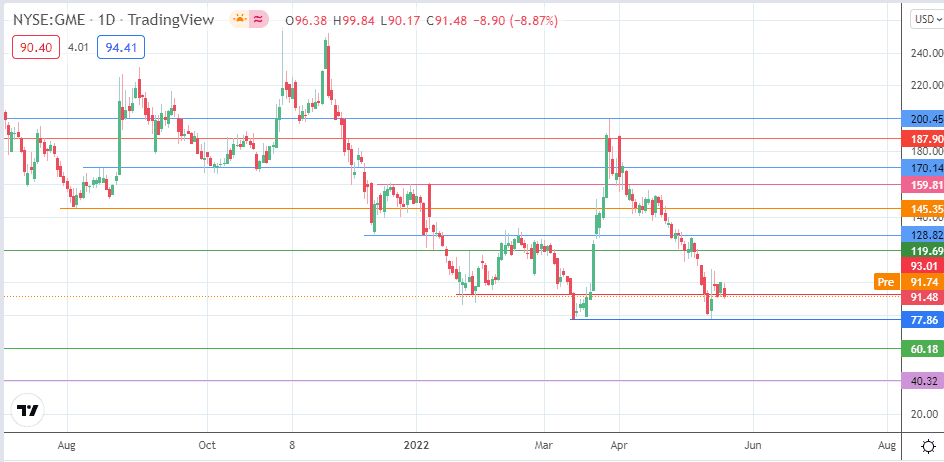

Technically speaking, the decline seen in the Gamestop stock price started from the double top of 28 March and 1 April, with the expanding triangle extending the downward correction that has ended up in the evolving pennant pattern.

GameStop Stock Price Outlook

The evolving pattern on the daily chart is that of a bearish pennant. Wednesday’s decline challenges the support at 93.01 (11 March 2022 low), courtesy of the support violation to the downside. This support remains vulnerable even as the bulls push for a return move. A breakdown of this pivot gives the bears access to the support at 77.86 (14 March and 12 May lows). A further decline lowers the stock price, targeting the 8 February 2021 low at 60.18. Attainment of 60.18 completes the bearish pennant pattern on the daily chart. Additional support is seen at 40.32, where a previous low of 18 February 2021 is found.

On the flip side, a bounce on the 93.01 support line allows for recovery, taking the price activity towards 119.69 (26 January high) if the momentum is strong enough. Above this level, 128.82 (11 February high) and 145.35 (4 August 2021 and 22 April 2022 high) form additional targets to the north. Any upside moves along the lines described invalidates the expectation of the pennant.

GameStop: Daily Chart