- The FTSE 100 is well into a third week of gains, propped up by the performance of mining stock Polymetal International.

The FTSE 100 index is up 0.76% this Tuesday after shares in Polymetal and airlines stocks attracted top demand on the index. Polymetal International has been the standout leader this week, notching strong double-digit gains as it seeks to insulate its business from potential Russian sanctions.

Investors have demanded this stock heavily as its fundamentals remained solid despite the panic-induced selloff last week. Also making it to the gainers’ chart are stocks of Coca-Cola, Melrose, online grocery chain Ocado, and International Consolidated Airlines Group.

Top mining and oil firms Glencore and BP are among companies on the losers’ chart, as commodity prices take a breather from recent highs. Also on the losing side of things is Barclays, which reported a bond trading loss that resulted from poor risk management in its US trading activity. Other losing stocks like BAE Systems.

Fresnillo and BAT suffered losses not exceeding 2.5%, ensuring that Polymetal’s impressive 39% gain was able to prop up the FTSE 100 index, keeping it well into its third week of gains. The FTSE 100 has pared some of the day’s earlier gains but still remains firmly in green territory.

FTSE 100 Index Outlook

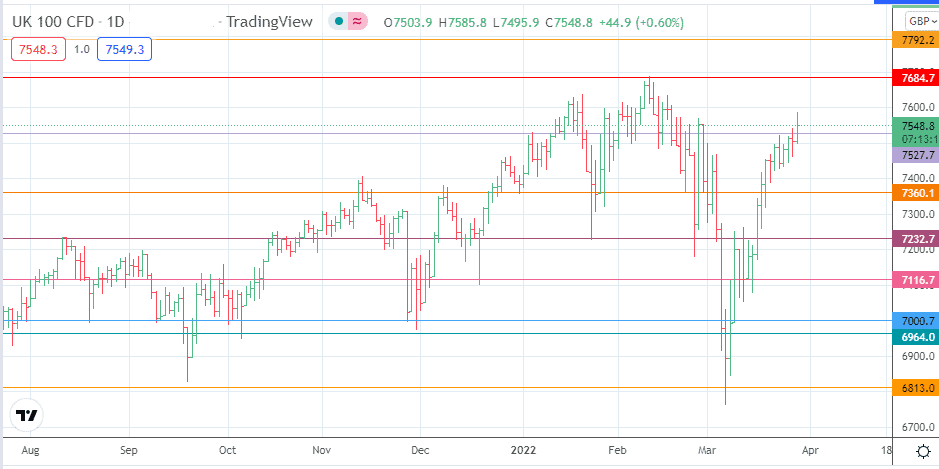

The uptick of the day has violated the 7527 resistance level. If the index extends its gains, the 7648 resistance (10 February 2022 high) becomes the next target. This resistance is the last point to cross before the FTSE 100 index hits the January/August 2018 highs at 7792. Above this level, the all-time high at 7903 beckons.

On the other hand, failure to achieve sufficient bullish momentum to aim for 7684 could put the 7527 support under pressure. The collapse of this support level opens the door toward the 7360 price mark (31 December 2021 and 26 January 2022 lows). 7232 and 7116 are additional targets to the south, with the 7000 psychological support (and 19 August 2021/9 March 2022 lows) coming into the picture on further price deterioration.

FTSE 100: Daily Chart

Follow Eno on Twitter.