- Oil stocks and the financials endure a brutal selloff on Monday, sending the FTSE 100 down by 2% and on course for a 30day losing streak.

The FTSE 100 index is sharply lower this Monday, as a selloff in commodity-linked and financial stocks puts the UK markets under immense selling pressure. The selloff puts the index on course for a 3-day losing streak, ahead of earnings reports for the 1st quarter of 2022 for several of the UK’s leading banks. Shares in Lloyds, Natwest, and HSBC are all trading lower.

Shares of crude oil majors such as BP and Shell were heavily down, with BP losing 5.37%. Metal stocks Rio Tinto was also down after shedding 4.89% in early trading. Anglo-American tops the losers’ chart with a 620% deficit, while Aveva Group and Glencore made up the number 2 and 3 positions on the FTSE 100 losers’ chart with losses of 5.8% and 5.61% as of writing.

Reckitt Benckiser, Unilever, Pearson, and Hikma Pharma all notched marginal gains on a day where only six stocks listed on the FTSE 100 index are in green territory, three hours into the trading session. Only the gains of Polymetal prevented the FTSE 100 from falling by much more. The stock rose 3.7% in early trading after reporting a 4% increase in year-on-year revenues to $616 million on rising gold prices. The FTSE 100 index is down 1.98% as of writing.

FTSE 100 Index Outlook

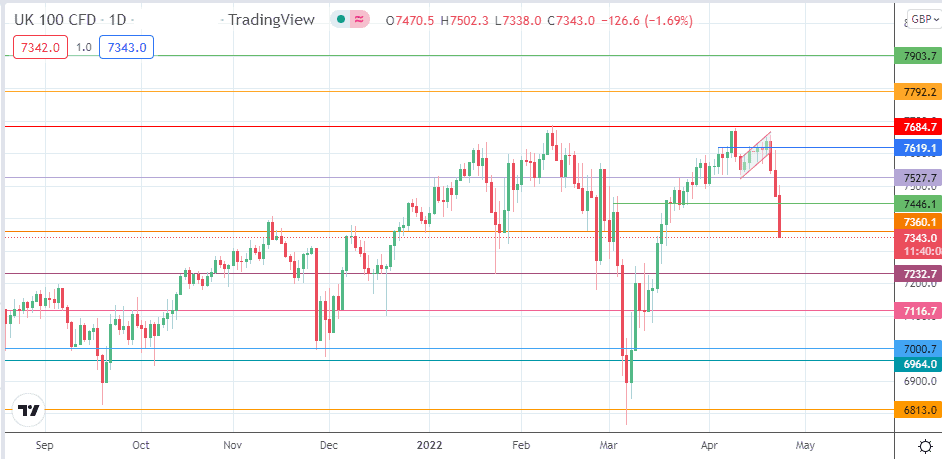

Monday’s selloff has violated the support at the 7360.1 price mark (31 December 2021 and 22 February 2022 lows). The breakdown of this support requires a price/time filter confirmation. A 3% penetration close below this support delivers the required affirmation and opens the door towards 7232.7 (3 November 2021 and 24 January 2022 lows). Additional support comes in at the 7116.7 price level (6 December 2021 and 14 March 2022 lows), and at the 7000.7 psychological price mark, which features lows last seen on 26 November 2021 and 9 March 2022.

On the flip side, the bulls need to defend the 7360.1 support and initiate a bounce for 7446.1 (31 January and 24 March 2022 lows in role reversal) to re-enter the picture as a northbound target. A break of this resistance clears the way for a march towards 7527.7 (5/26 January and 23 March 2022 highs). The 17 February and 5 April highs at 7619.1 and the 10 February 2022 high at 7684.7 complete the short-term price targets to the north if the advance exceeds 7527.7.

FTSE 100: Daily Chart

Follow Eno on Twitter.