- The FTSE 100 is in a sharp decline today as traders react to sharp contraction of US stocks yesterday. Here are the reasons why it has fallen sharply

The FTSE 100 index is down by more than 1.58% today as investors reflect on the sharp sell-off in the United States yesterday. The index is trading at £5,818, which is substantially lower than this week’s high of £6,000. The same story is happening in other European indices, with the DAX index down by 0.45% and the CAC 40 falling by 0.40%. The pan-European Stoxx 50 index is down by 0.33%.

Valuation is the main reason why global stocks have started to fall. As we have written before, the fear and greed indexhas moved to the extreme greed zone, which is a sign that investors have gotten a bit greedy. This has seen companies achieve extremely stretched valuations. For example, the so-called big five have a market cap of more than $8 trillion, about 40% of the entire US GDP. These companies are Amazon, Facebook, Google, Apple, and Microsoft. Apple itself has even become more valuable than all firms in the FTSE 100.

These valuations have happened at a time when the world is going through its deepest contraction in decades. Indeed, according to the World Bank, the world economy will shrink by more than 5% this year. Meanwhile, in the United States, Democrats and Republicans have disagreed on the volume and size of the next stimulus package.

Strong US data pushes stocks lower

Another reason why the FTSE 100 and global stocks are falling is because of the recent impressive data from the United States. This week, numbers like manufacturing, service, and factory orders have been relatively strong, meaning that the Fed could hike rates faster than analysts expected.

While most companies in the FTSE 100 are in the red, some are in the green. The best performers today are iTV, IAG Group, Fresnillo, and NatWest Bank. These shares have risen by more than 1.50%. On the other hand, the biggest decliners are Barratt Developments, Scottish Mortgage, Persimmon, and Experian that are down by more than 2%. The notable gainer is RyanAir, the budget carrier whose shares have jumped after the company raised more than 400 million euros.

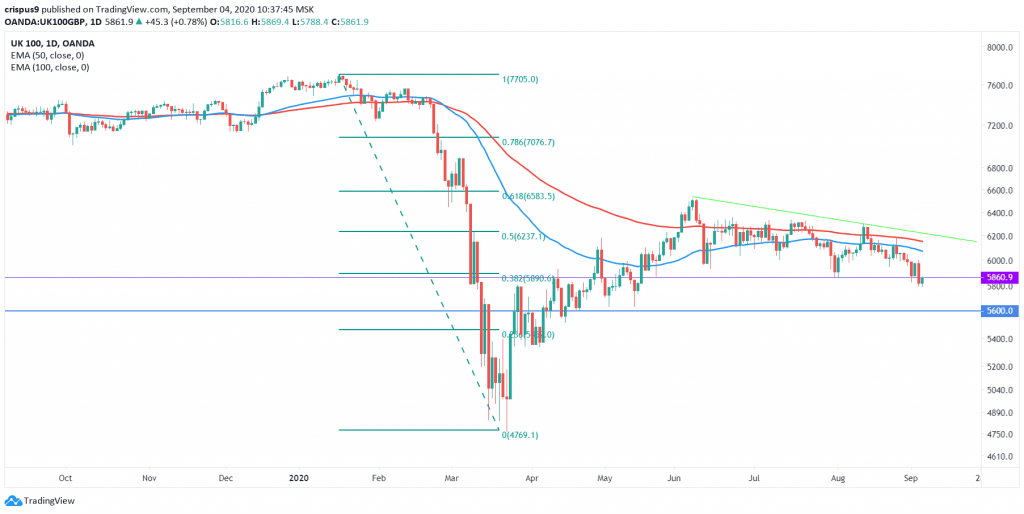

FTSE 100 technical analysis

The daily chart shows that the FTSE 100 index has been under bearish pressure this week. This is shown by the descending green line. The price is also below the 50-day and 100-day moving average. It is also along the 38.2% Fibonacci retracement level. Most importantly, it has moved below the support at £5,860, which its lowest level on July 31st, August 1, and May 22.

Therefore, the index is likely to continue falling as bears target the next support at £5,600. On the flip side, a move above the psychological level of £6,000 will invalidate this trend. Interested in learning more about technical analysis? You can check enroll in our free trading course here.