- FTSE 100 started the trading session higher for the second straight day as the correction in British pound continues, supporting the exporting constituents

FTSE 100 started the trading session higher for the second straight day as the correction in British pound continues, supporting the exporting constituents of the FTSE 100. The pound is under pressure as we are heading closer to a no-deal Brexit. As the eighth round of negotiations restarts this week, there are significant differences in critical issues such as fishing rights and state aid. PM Johnson said that if a deal has not been agreed by October 15, the two parties should go for a WTO style trading relationship.

The recent correction in GBP has helped FTSE 100 to outperform its major peers but still lagging the performance of Dax and Wall Street indices.

The previous week economic data from the UK showed mixed signals. The UK Markit Services PMI falls to 58.8 in August below the forecasts of 60.1. The Manufacturing PMI registered in at 55.2 marking the highest reading since February, and above the July reading of 53.3. In the housing market, the Nationwide Housing Prices came in at 2% in August, beating the expectations of 0.5%.

On the corporate front, Lloyds Banking Group is 0.63% higher at 27.14. Melrose Industries is 0.25% higher at 122.80 after the company plans big job cuts at its Aerospace sector. BT Group is 2.56% higher at 106.20.

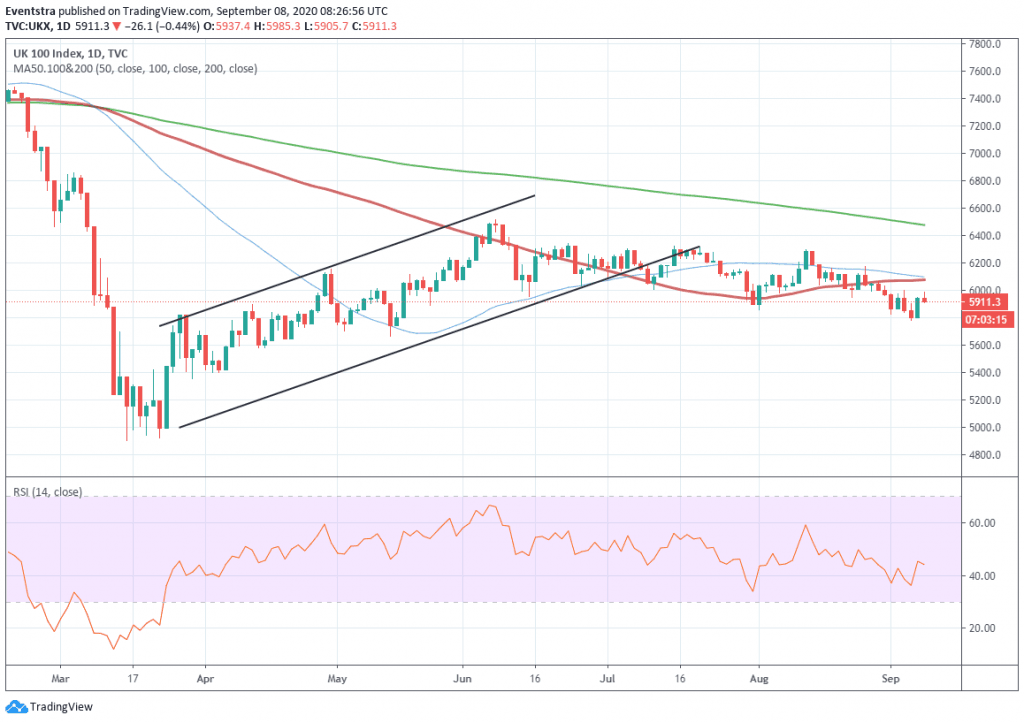

FTSE 100 Technical Analysis

FTSE 100 started the session higher, but as of writing gives some of the gains and trades 0.21% higher at 5,950. The index managed to rebound from four-month lows, but the technical picture continues to point to lower levels. The index has turned bearish after the previous week breached below the 100-day moving average.

Bulls face intraday resistance at 5,985 the daily top. More sellers would emerge at 5,999 the high from September 3. What can cancel the bearish momentum is a return above the 100-day moving average at 6,069.

On the other side, support for the FTSE 100 index is at 5,937 the daily low. If the selling pressure persists then the next support is at 5,781 the low from September 4. More bids would emerge at 5,656 the low from May 14.