- USDCHF remains under downside pressure near the 0.79 psychological level, as structural US dollar weakness collides with renewed safe-haven demand for the Swiss franc.

- Risk-off sentiment and policy uncertainty in the US continue to cap dollar upside. FXStreet noting accelerating flows into defensive currencies amid elevated macro uncertainty.

- Near-term price action is likely to remain range-bound with a bearish bias, with 0.79 acting as a key decision level and rallies favored as selling opportunities.

USD/CHF’s upside potential remains subject to persistent downside pressure in early January 2026 near the 0.79 psychological handle, which has since risen to be of relevance for short-term direction. More importantly, the price action reflects a much larger story playing out in global markets right now: structural US dollar weakness coming up against renewed investor demand for safe havens like the Swiss Franc.

Recent sessions find USD/CHF fighting to stay in recovery, but attempts have met selling interest. “Renewed risk-off and a softer US dollar backdrop remain supportive of defensive currencies, and flows into havens including the Swiss Franc have accelerated with macro uncertainty in focus, “FXStreet reported (FXStreet, January 2026).

This dynamic implies that USD/CHF is not just being dictated by Swiss-specific considerations now, but more broadly through a general reprising of global risk and US monetary credibility.

US Dollar: Policy Uncertainty and Eroding Confidence

From the US side of the equation policy ambiguity and changing interest-rate to expectations are keeping a lid on the dollar’s strength. Market are jittery, with headlines questioning the independence of the Federal Reserve and its future policy direction. There was no immediate shift in policy; however, the notion that the future could be uncertain has been sufficient to cap dollar appetite.

As highlighted by Investing.com, the dollar index has been trading on the back foot, unable to gain any traction to the outside despite some safe-haven bids. The platform writes that expectations of looser US financial conditions into 2026 or keeping the greenback capped against all the currencies, including USDCHF.

This is especially relevant for USD/CHF, with a pair having a tradition of reacting both to rate differentials and credibility, as well as stability risk premia incorporated in the US dollar. And when those premiums come off, the Swiss Franc tends to outperform.

Swiss Franc: Safe-Haven Demand With SNB Constraints

On the other side of the fence, the franc remains buoyed by its traditional safe haven and capital preservation credentials in Switzerland. Increased geopolitical risks and weaker global mood are convincing investors to move into low volume havens, which is supportive of CHF demand.

Having said that, the Swiss National Bank (SNB) is still a significant modulating influence. Policymakers have frequently expressed discomfort with too much franc appreciation, which would potentially weigh on Swiss export and inflation. But critically the SNB has not sparked urgent expectations of aggressive easing.

USDCHF Market Commentary

The Business Times noted that USDCHF was “hovering within a slim but dangerous range as the Swiss National Bank (SNB) stands pat and the US Federal Reserve grows more dovish.”Basically, this is policy asymmetry that, in practice, has taken off the downside pressure on the franc and given nothing to a languishing dollar.

In other words, even though the SNB may jawbone against CHF strength, the lack of action confines its capacity to contained safe haven flows.

Technical Structure: Correction or Continuation?

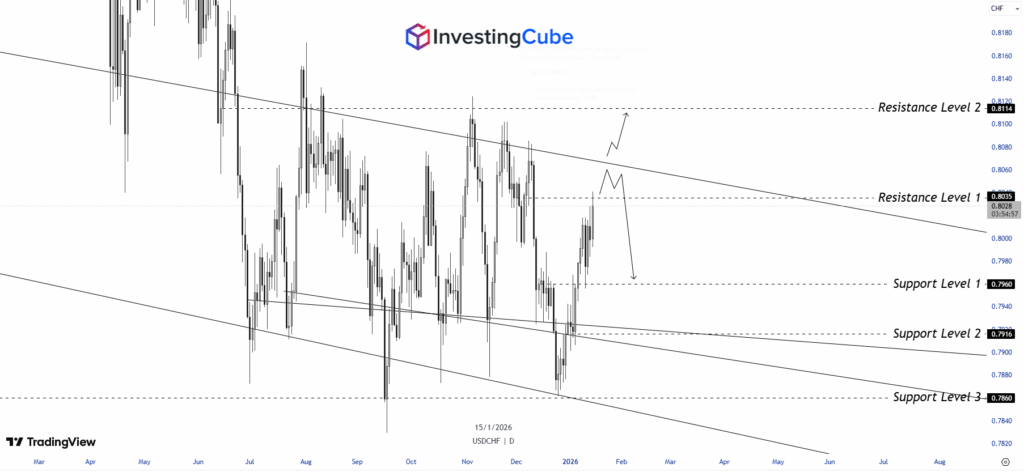

Technical speaking, the view is almost unanimous that there is a bearish medium-term structure in USDCHF (with some shallow recovery attempts). ActionForex mentions that the pair has declined slightly from the 0.7828 low, but adds it seems “more corrective than reversal”, easing the downside pressure in a near-term perspective.

ActionForex added, “While another recovery cannot be ruled out, USDCHF is likely to remain under pressure as long as the short term ceiling at the 0.8016 or 0.8023 resistance holds” (ActionForex, USDCHF Outlook). This rejection area also happens to lineup with previous breakdown support and descending trendline resistance, adding weight to its technical importance.

Widely monitored technical levels include:

Support: 0.7960, 0.7916, 0.7860

Resistance: 0.8035, 0.8114

Close below 0.7860 on a daily basis would likely confirm fresh bearish continuation and open the door to new cycle lows. On the flip-side, a sustained move back above 0.8016 will be required to negate immediate downside pressure and sentiment back in favor of a wider ranging pattern.

Outlook: Sideway’s Tension With a Bearish Bias

Also in the near term, USDCHF should mostly trade sideways, having 0.79 as a critical call level for both momentum and positioning decisions. Given fragile risk sentiment and softness in US macro confidence so far, traders can bet on some follow-through selling.

Further ahead, the risks to the outlook continue to be tilted to the downside. A revival in risk aversion, downbeat US stats, or further confidence loss in the US establishment would strengthen CHF in such an environment. USDCHF rallies are probably better suited to be used as selling opportunities and not the beginning of a sustainable move higher.

The only thing could turn positive for the pair will be a strong revival US. economic momentum, or a new hawkish position from the Federal Reserve.

It serves as a psychological threshold and technical support. A clear break below the mentioned level might now turn the pair vulnerable to the downside towards the 0.78 handle.

Talking the greenback lower and slow its rise, but with no specific policy, it is unlikely to be effective during a safe-haven demand scenario.