- USD/ZAR remains range bound as Rand support from strong gold prices offsets softer short-term U.S. dollar momentum.

- Price action has shifted from trend trading to consolidation, signaling tactical positioning rather than a macro regime change.

- Key technical levels define the range, with downside risks below support and limited upside unless resistance is cleared.

Market Overview

The USD/ZAR pair is currently trading within a range as the South African Rand remains well bid and the US dollar has softened out over the short run. As for today, USD/ZAR is fluctuating with intraday movements as it spins with no definite direction into follow-through.

Price action over the last few weeks suggest a shift from trend trading to range trading. “USD/ZAR is consolidating after recent downside pressure, with price action favoring range trading rather than directional conviction”(Daily Forex, January 19, 2026). That is a sign that this is more a market of tactical positioning than some sort of macro sea-change.

Fundamental Drivers

South African Rand: Commodity Support and Risk Sentiment

The South African Rand has been benefiting from strong precious metal prices, especially gold which has increased value. Movement in the value of bullion has a direct bearing on the currency as South Africa is one of the world’s biggest gold producers. “the South African rand has been buoyed by higher gold prices, which continue to support commodity-linked currencies” (Reuters, January 14, 2026).

An emerging-market currencies have also had some support from a slight improvement in global risk sentiment. Reuters also observed that “improving risk appetite has allowed the rand to stabilized against the dollar” (Reuters January 15, 2026). These have been restricting the upside in USD/ZAR even with the US dollar’s yield superiority.

But analysts persist in warning that the Rand’s strength is contingent. FX leaders emphasized that “the rand’s gains remain fragile and highly dependent on favorable global conditions” (FX Leaders, January 19, 2026) highlighting ongoing structural vulnerabilities persist such as low growth prospects and continued sensitivity to capital flows.

US Dollar: Yield Advantage but Reduced Momentum

On the US front, the dollar continues to be underpinned by relatively high interest rates and robust economic fundamentals. Yield spreads still favored the dollar over most of its emerging-market currencies, and this is causing a balancing act for USD/ZAR.

That said, fading upside momentum is evident in recent trading activity. Along the same lines, Reuters noted that “ the dollar has struggled to extend gains as investors await clearer signals from upcoming US economic data” (Reuters, January 16, 2026). This caution has taken some pressure of USD/ZAR in the short term, and this contribute to the current consolidation phase.

Technical Structure and Price Action

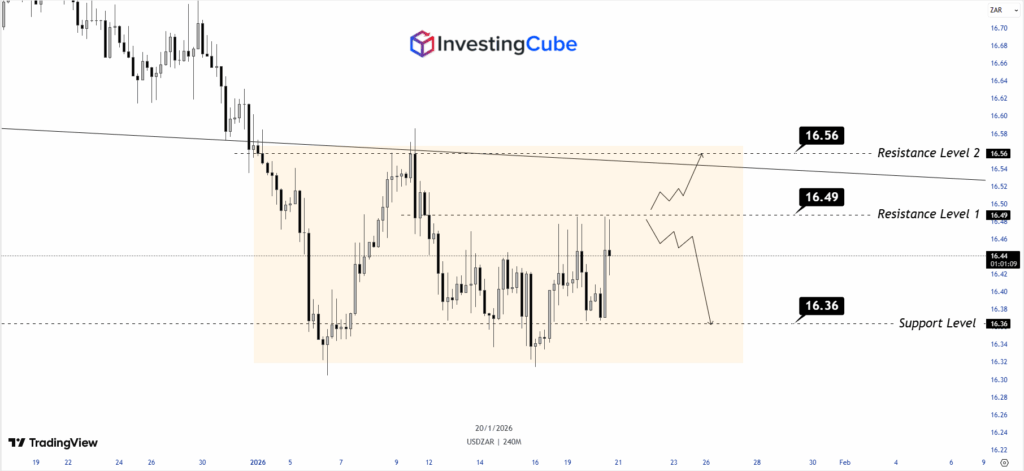

USD/ZAR has so far been trading in a clear consolidation range following the earlier depreciation which suggest that sellers are taking a breather unfinished trend, but want to see more evidence before calling for relief. The price is now ranging, which indicates temporary equilibrium between buyers and sellers.

The chart establishes a strong range with support at 16.36 and resistance over top at 16.49 and 16.56. Several test of the 16.36 support zone have not proven to stage any aggressive breakdown, indicating some short-term demands is still evident in this market, but reactions from here have been corrective with no follow-through strength.

On the upside, 16.49 acts as initial resistance while 16.56 aligns with the descending trend line, reinforcing it as a confluence resistance zone. As long as price remains capped below this area, upside moves are likely to be viewed as corrective rather than trend-changing.

A solid close above 16.56 would indicate bullish extension with a clear break below 16.36 to confirm downside pressure is back on. For now, we expect USD/ZAR to trade in the band.

Short-Term USD/ZAR Price Prediction

For now, it can be seen that USD/AR is ranging, until that big macro event disturbs that pattern. A definitive break below 16.35 could indicate that the Rand has gained strength again, opening up for the losses towards the 16.20 to 16.25 area. FX Leaders noted that “ a sustained move below support could accelerate downside as technical stops are triggered” (FX Leaders, January 19, 2026).

On the flip side, a convincing move beyond 16.50 would suggest renewed US dollar interest probably led by upbeat US data or fresh global risk-off. If that is the situation then potential upside expectations could reach 16.65 to 16.75.

Medium-Term USD/ZAR Price Prediction

In terms of the bigger picture, institutional commentary highlighted that USD/ZAR softness might be more occidental, as opposed to structural. ExchangeRates.org.uk do reported that “expectations for further rand strength in 2026 remain highly sensitive to global risk conditions” (ExchangeRates.org.uk, January 14, 2026).

This suggest that although there may be bouts of strength in Rand, any meaningful downtrend for USD/ZAR is likely to be reversed should global volatility increase while US yields continue to trend higher.

Conclusion

USD/ZAR is still in range as markets weigh Rand support from commodities against the continued resilience of the US dollar. Short-term sentiment is slightly bearish, but there is poor conviction. As Reuters put it: “ emerging-market currencies are holding steady, but remain vulnerable to sudden shifts in global sentiment” (Reuters, January 15, 2026).

Until a clear breakout occurs, USD/ZAR is likely to continue trading within a defined range, favoring tactical positioning over aggressive directional strategies.

Frequently Asked Questions

USD/ZAR is range-bound as Rand gets support from strong prices and negate the US dollars yield advantage.

It was thought that a break higher would follow through as macro factors, for example, US data surprises and shift in global risk sentiment.

Analyst see recent Rand gains as being tenuous and subjected to global risk conditions.