- USD/TRY climbs to fresh all-time highs above 43.40 following a cautious but persistent easing cycle by the CBRT.

- The Central Bank of the Republic of Turkey (CBRT) cut its policy rate to 37% last week, undershooting market expectations but signaling a continued downward path.

- Inflation remains sticky at 30.9%, keeping real yields under pressure and the Lira's path of least resistance firmly to the downside.

USD/TRY has extended its record-breaking run this week, trading near the 43.40–43.45 region as of Tuesday. This follows the Central Bank of the Republic of Turkey’s (CBRT) first policy meeting of 2026, where officials lowered the benchmark one-week repo rate by 100 basis points to 37%.

While the cut was smaller than the 150 basis points some analysts had anticipated, it confirmed that the easing cycle, which began in late 2025, is still very much in play. The move has reinforced the “orderly depreciation” trend of the Lira, as the market balances a slightly more cautious central bank against a backdrop of double-digit inflation.

Cautious CBRT Easing Meets Sticky Inflation

The dominant driver for the pair remains the divergence between Turkey’s interest rate path and its inflation reality. Annual inflation ended 2025 at 30.89%, and while this is a significant improvement from previous years, the recent 27% minimum wage hike and New Year price adjustments are expected to make January readings “noisy” and volatile.

Yenisafak reports that although the CBRT is attempting a “balancing act” to support economic activity, the shift to a 37% rate leaves little room for a positive real yield buffer if inflation surprises to the upside in Q1 2026. This lack of a significant “real-rate” cushion continues to deter long-term capital inflows into the Lira, keeping the bias for USD/TRY firmly skewed to the upside.

US Dollar Stability Dampens Lira Recovery Hopes

On the other side of the Atlantic, the US Dollar has maintained a steady footing. Markets are currently pricing in a “measured” approach from the Federal Reserve as they navigate early 2026 data. Bloomberg analysis suggests that as long as US yields remain resilient, the “carry” advantage for the Lira is not yet strong enough to reverse the broader trend, especially given the political and structural risks inherent in the Turkish economy.

Without a major dovish shift from the Fed or a hawkish surprise from the CBRT, the USD/TRY pair is likely to continue its “gradual grind” higher.

USD/TRY Technical Outlook: Bulls in Control

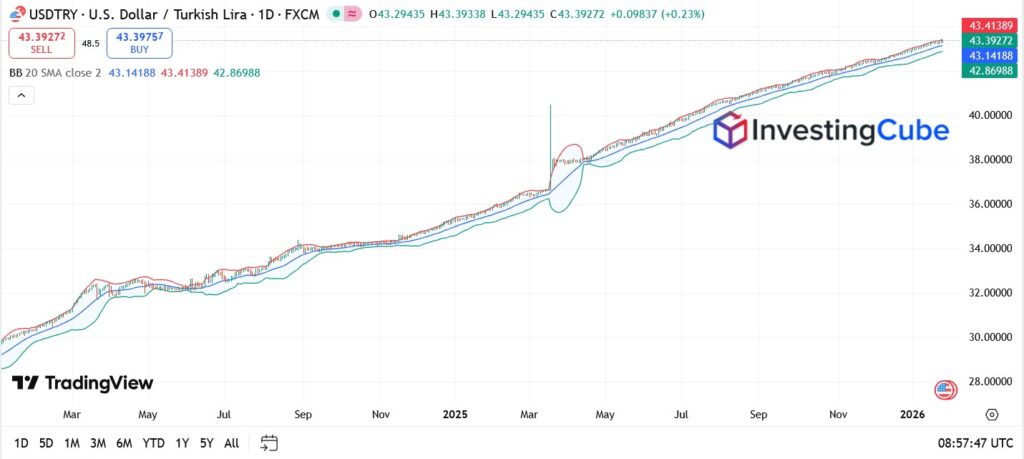

The technical structure remains textbook bullish. Looking at the daily chart, the pair continues to ride its ascending support levels with precision:

- Trend Strength: Price action is comfortably trading above the 20-day and 50-day moving averages, which are acting as dynamic support on minor pullbacks.

- Key Pivot: The 43.00 level has transitioned from a stubborn resistance to a rock-solid psychological support floor.

Key Levels to Watch for the USDTRY

- Support: 43.10 (recent breakout zone), followed by 42.80.

- Resistance: 43.45 (current ATH), followed by the 43.60 extension target.

Writer’s Trade Idea: I remain bullish on the pair, looking to enter long positions on pullbacks toward the 43.15 level, targeting a move to 43.60, with a protective stop-loss placed below 42.80.

Outlook: The Grind Higher Persists

The broader outlook for USD/TRY remains anchored in structural Lira weakness. While the CBRT’s 100bps cut was “cautious,” it still represents a loosening of monetary policy in an environment where inflation is still over 30%.

As FocusEconomics panelists have noted, the uncertainty surrounding the end-2026 inflation target (currently 16%) means that investors will likely continue to treat the USD as the primary store of value in the pair. Barring an aggressive policy pivot or a massive drop in global energy prices, the path toward 44.00 looks increasingly clear for 2026.

Even though the 100bps cut was smaller than the 150bps expected, it still confirms that the CBRT is committed to lowering rates while inflation remains near 31%. This narrows the “real yield” and signals to the market that the easing cycle is not over.

Currently, no. The technicals show a series of higher highs and higher lows. For a reversal to occur, we would need to see USD/TRY break and close below the 42.50 support level on a weekly timeframe.

Recent market participant surveys conducted by the CBRT suggest a year-end forecast for 2026 hovering around the 51.00 mark, indicating that the market expects the gradual depreciation to continue throughout the year.