- USD/SEK trades around 9.10 with a bearish bias.

- Morgan Stanley and Bank of America favor SEK strength into 2026.

- Technicals support downside toward 9.05 - 9.00.

- Rebounds likely remain corrective unless 9.27 breaks.

Overview

USD/SEK is subjected to renewed downside pressure as a weak U.S. dollar broadly meets with stronger medium-term SEK fundamentals and more supportive institutional forecasts. The pair is around the 9.12 – 9.13 area as of January 21, 2026 within striking distance of a major technical support level.

Near-term indicators are biased on the downside and market sentiment points to Sek strength. Given the dollar weakness on softer yield expectations and investors increasingly rotating into underpriced European currencies, USD/SEK is offered more downside in the near term. Rebounds are still possible if global risk sentiment melts down or U.S. macro data surprise to the upside.

Fundamentals & Market Sentiment

The macro environment remains supportive of the Swedish krona to the US dollar. The US dollar continued to face pressure on the back of lower US Treasury yields, warning inflation expectations, and as market players are now virtually convinced that the Fed’s tightening cycle is already history. That has diminished the dollars yield advantage and made it less appealing as a haven currency in recent sessions.

institutional attitude towards the krona has shifted further closer into 2026. Morgan Stanley recently said that the SEK could be set to beat the US dollar in Q1 2026, stating that the krona is “well positioned to benefit from a cyclical recovery and valuation normalization” (Morgan Stanley, cited by Investing.com, Jan 2026). Sek is still one of the most undervalued currencies in a G10 complex and a significant beneficiary from better European growth dynamics.

Likewise, Bank of America now expects the krona to continue rising in a medium-term. In its 2026 FX outlook, Bank of America noted that “SEK is likely to strengthen against both USD and EUR valuation gaps close and capital flows return to Scandinavia” (Bank of America, cited by Investing.com, January 2026). The report highlighted relatively stable macro fundamentals and improving current-account dynamics in Sweden that could offer further support for the krona.

More general risk sentiment has also been supportive. The better tone to global equities (with downside volatility is still controlled) and the associated the demand for high-beta G10 currencies. This environment is one that generally should be supportive for SEK and has been challenging to attract new safe-haven flows into the USD. “The dollar’s dominance is fading as yield differentials narrow and investors look beyond the USD for value” (ING, G10 FX Outlook 2026, December 2025).

That being said, the basic view isn’t one-sided. A rebound in global risk aversion, upside US data surprises, and Fed communication hawkish enough to trigger a reaction could temporarily or even reverse USD/SEK downside. Furthermore, still-presently in European growth and the backdrop for global trade constitute a medium-term risk to SEK.

Technical Structure

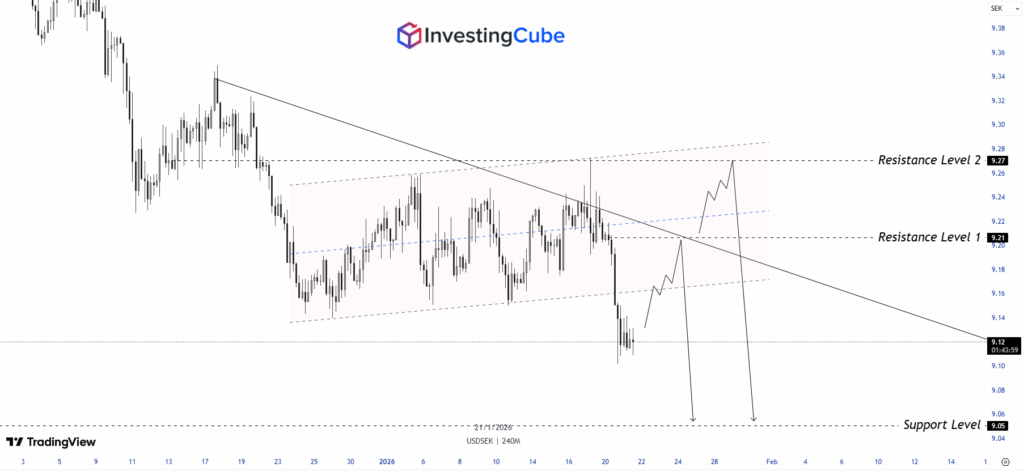

Technically, USD/SEK is trading in a near-term downward correction. The pair has been churning out lower highs and lower lows after being forcefully rejected from a failed break above the 9.27 – 9.30 zone earlier in the month. Price action is currently consolidating a hair above the 9.10 level, an area that has served as near-term demand zone in recent sessions.

A strong downward close below 9.10 would leave the next downside target in the area of 9.00 to 9.05, a psychological significant round-number area that also conflates with prior consolidation bases. After that, a further decline to 8.85 – 8.90 shouldn’t be ruled out in the case of intensified bearish action.

Resistance is seen beginning at 9.21, then a more meaningful supply zone exists above it from around 9.27 up to 9.30. A move back over 9.30 is needed to neutralize the immediate bearish structure and return focus to a range trade or recovery theme.

USD/SEK Price Prediction and Outlook

Base Case (Bearish Bias)

USD/SEK is expected to keep the offered bias while trading within the prevailing macro and technical context. Further dollar weakness and increased liking for the krona would keep prices going down along a sloping line towards 9.05 and perhaps 9.00 in the next few days or weeks. In such a situation, rebounds should fade and be sold into near resistance.

Alternative Scenario (Range Rebound)

In case 9.10 holds and sentiment risks weaken globally or US yields pick up, USD/SEK may reverse towards 9.21 and 9.27 on a corrective phase, but until we see a significant change in Fed expectations or SEK underpinnings that could carry on deteriorating, this will likely continue to be corrective rather than signs of an uptrend turning.

Risk Scenario (Bullish Reversal)

A move towards 9.35 to 9.45 on the other hand, would probably require a fresh wave of dollar buying to ripple through the market, something that is likely to materialize only in reaction to either a hawkish repricing of US monetary policy or a significant deterioration in global risk appetite overall. Whilst not the central view, it is an outcome that cannot be fully excluded, given macro-driven FX markets have a tendency to overshoot.

Key Levels to Watch

Resistance Level: 9.21, 9.27

Support Level: 9.05, 9.00

Frequently Asked Questions

Dollar weakness, falling US yields, and improving sentiment toward the Swedish krona are weighing on the pair.

The 9.10 is critical. A break can expose 9.00 – 9.05.

A sustained move above 9.27 or a sharp resurgence in USD demand.