- Strong U.S. growth and Japan's policy hesitation keep USD/JPY firm near 150.00. Traders focus on upcoming data and BOJ signals.

Strong U.S. growth and Japan’s policy hesitation keep USD/JPY firm near 150.00. Traders focus on data and BOJ signals.

U.S. Data Surprise Fuels Dollar Momentum

The latest U.S. GDP revision to 3.8% annualized, alongside a 0.9% surge in consumer spending, gave the dollar a strong lift. Just weeks ago, the narrative was about slowing labor markets and potential early cuts from the FED. Now, resilient consumption — the backbone of over 70% of U.S. GDP — has changed that picture.

For USD/JPY price prediction, stronger U.S. growth directly pressures the yen. Powell’s cautious tone on rate cuts tells markets the Fed won’t rush, keeping yields and dollar demand intact against low yield currencies.

Japanese Policy Stalemate Adds Pressure

The yen’s weakness is not just about the dollar. The BOJ once again held rates, despite dissenting voices inside calling for normalization. With the LDP leadership election just around the corner, traders worry a dovish outcome could push hikes further into the future.

This policy gap is central to USD/JPY price prediction. Even as geopolitical risks rise, capital is not flowing into the yen. Instead, the higher-yielding dollar remains the safer choice in the eyes of investors.

Key things to watch:

- BOJ rhetoric vs. Fed caution

- LDP leadership election outcome

- U.S. inflation releases

Weak Japanese Data Reinforces Downtrend

Japan’s September manufacturing PMI tumbled to 48.4, its 14th contraction in 15 months. It’s a reminder that the Japanese economy has yet to find stable footing. For investors, such weakness makes it harder to justify holding the yen when stronger alternatives exist.

For USD/JPY price prediction, the data underline that rallies in the yen are likely to be short-lived without genuine growth or BOJ tightening.

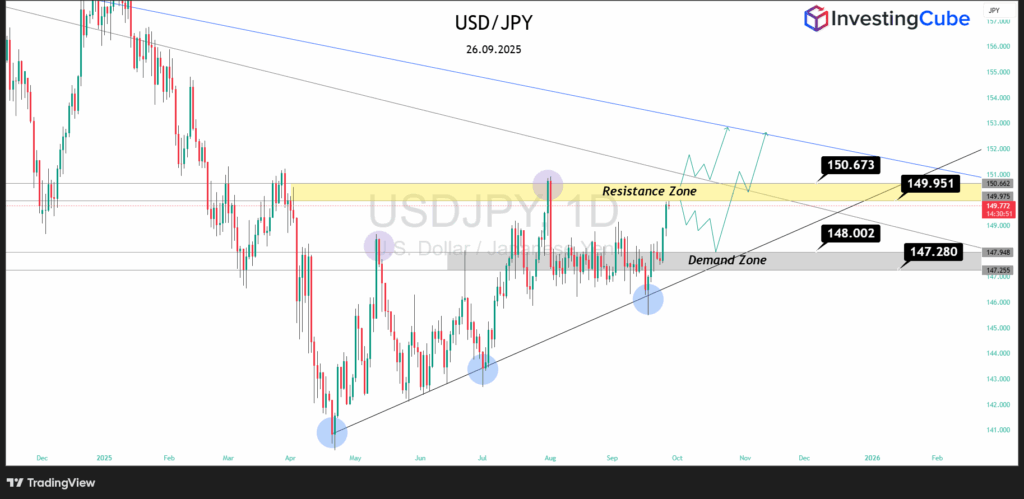

Technical Outlook: Resistance at 150.67, Support at 147.28

The chart shows USD/JPY testing the resistance zone between 195.95 – 150.67. A clear break above this zone could open path toward 151.50. – 152.00, in line with the broader bullish channel.

On the downside, the demand zone rests around 148.00 – 147.28. As long as the pair holds above this level and the rising trendline from May’s lows, the bullish structure remains valid.

- Resistance Zone: 149.95 – 150.67

- Support/ demand zone: 148.00 – 147.28

- Trend bias: bullish while holding above 149.05 and trendline support

This setup matches the macro narrative: dips into support are likely to attract fresh buyers, with the 150.00 handle acting as the near-term battleground.

Outlook and Technical Considerations

All in all, USD/JPY price prediction leans toward continued dollar strength. With U.S. data resilient, the Fed steady, and Japan still hesitant on normalization, the yen finds little support. Market participants should watch upcoming PCE Inflation data and BOJ commentary, but the playbook remains: dips are more likely to be bought than sold.

O&A – Reader Checkpoints

Because it offers both global liquidity and yield. The yen’s ultra-low returns weaken its safe-have role even when risks rise.

The gap remains the core driver. As long as U.S. yields stay elevated while Japan sticks to ultra-low rates, upward pressure on USD/JPY persists.