- The Federal Reserve looks set to stay hawkish in the first quarter of 2026 thanks to strong US economic data

- Japan's BoJ could be slow to institute aggressive policies in view of upcoming snap elections in February

- The BoJ previously intervened in 159.00-160.00 level and a repeat of the same is likely if the dollar grows too strong

The USD/JPY forex pair started 2026 strong, continuing its late 2025 climb. As of this writing, it’s up over 0.7% this year, trading close to the 158.00-159.00 resistance zone.It last broke through that zone in mid-2024. We discuss what the recent gains tell us and how the 2026 trajectory could play out.

Will the 158.00-159.00 Barrier Break?

A break above 159.00 in the near-term is likely but not guaranteed. MUFG Research notes that the dollar is still substantially strong still but expects it to weaken by about 5% in 2026. We might see a quick move past 159.00, maybe even reaching 160.00 briefly. Still, staying at those levels will be difficult if U.S. jobs data weakens.

Also, Japan’s Ministry of Finance is watching closely, and they’ve stepped in near 160.00 before. Japanese officials will probably warn against further rises and will likely take action if the move towards 160.00 gets too fast. That could lead to recovery of some of the yen’s recent losses.

What Awaits USD/JPY In 2026

Interest rates will be key in 2026, and the Federal Reserve is widely expected to cut rates. Markets expect two cuts by October. The risks depend on U.S. dollar strength and policy support. Strong U.S. economic data could widen the yield gap, while Japan’s inflation could push the BoJ to act.

Japan’s upcoming election adds uncertainty, with possibly delaying yen-boosting moves. This election, triggered by Prime Minister Sanae Takaichi’s coalition strategy, could surprisingly weaken the yen if the market perceives rate changes will be delayed. Historically, political uncertainty in Tokyo makes the BoJ cautious.

In essence, if the U.S. economy keeps doing better than Japan’s the dollar will likely stay strong. However, the 160.00 level is like a ceiling that might be hard to break through because of potential interventions by the BoJ.

USD/JPY Forecast Today

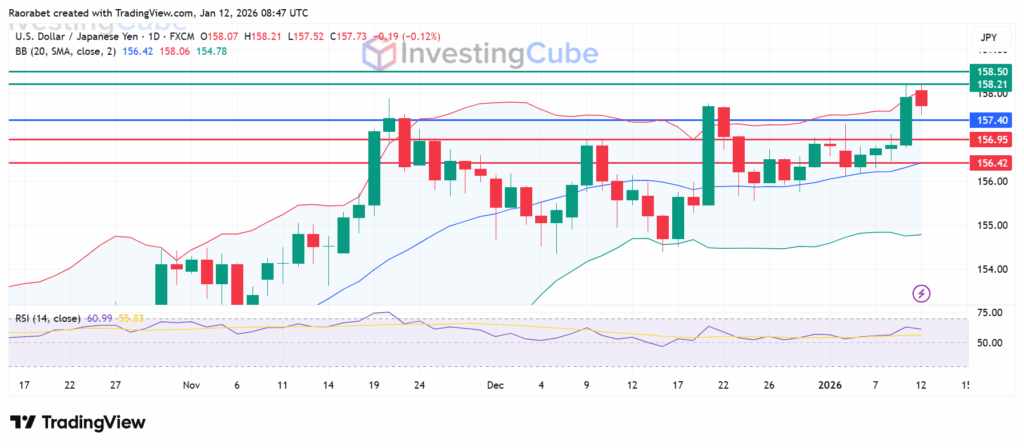

The USD/JPY trades at 157.73 on the daily chart below. The RSI is trending upward near 61, which suggests that the upward momentum is still strong and without the risks of being overbought. The next resistance level is at the 52-week highs of 158.21 which it tested the previous session and earlier in today’s session. If it breaks the psychological barrier at 159.00. Primary support is at 156.95, and a break below that will invalidate the upside narrative. The second support looks set to be at 156.42, corresponding to the middle Bollinger Band.

USD/JPY forex pair daily chart on January 12,2026. Support and Resistance levels created on TradingView

The main factors affecting the pair include the hawkish Federal Reserve policy and strong US economic data relative to Japan’s economy.

The Bank of Japan (BoJ) is likely to be slow to institute aggressive policies, which could disadvantage the yen and propel the USD/JPY further up.

USD/JPY last broke through that zone in mid-2024 and there’s a high likelihood of BoJ intervention if it signals a repeat action.