- Get the latest insights on the USD/INR technical outlook and identify crucial market movers. Stay updated for smart trading!

The indian Rupee trades cautiously around 88.24. The USD/INR is still close to its all-time high of around 88.60. For this week, it’s expected to see sideways trading on the USD/INR with investors waiting for the Fed’s decision.

Morgan Stanley analysts have forecasted that the Federal Reserve will cut interest rates three times during this year by 25 basis points. Citing that will be in response to the downside in the US labor market.

According to the CME Fed tool, market participants are pricing a 90% probability for cutting rates by 25 basis points to 4.00%-4.25%. The investor’s focus will be directed to the monetary policy statement and Chair Jerome Powell’s press conference.

This article will cover the key market movers that can affect USD/INR pricing. We will also provide a technical outlook for the currency pair and address the most frequently asked questions from traders.

USD/INR: Latest News

- The indian WPI inflation was just released today with a territory signal. In July, the WPI inflation was -0.58%, indicating deflation. But for August, it comes to 0.52% The move from negative to positive territory signals a reversal of the previous trend.

- A positive WPI indicates that inflationary pressures are building up at the producer level. This could eventually lead to higher prices for consumers, as measured by the CPI.

- The Reserve Bank of India RBI will monitor closely both the WPI and CPI to decide on the interest rates, avoiding higher inflation rates.

- India’s consumer price index has shown that pressure on prices is escalating. The retail inflation rose at an annual pace of 2.07%, almost near to the forecast of 2.1%. This is faster than the prior reading of 1.67%.

- These readings indicate that inflation growth remains below the RBI target of 3.7% for the current financial year.

- Moreover, the Federal Reserve decision this Wednesday holds vital importance for the USD/INR.

- The scenario of the Fed easing monetary policy with a dovish interest rate will be favorable for the Indian Rupee.

- However, the upside is limited to the USD/INR due to US-India trade tensions.

- Trump pushed the European Union to exert pressure on India to stop buying oil from Russia as he wants to end the war in Ukraine.

- He also blamed India for its payments to Moscow for oil, arguing that this will keep the war in Ukraine.

- Trump has already imposed additional tariffs on imports from New Delhi to 50%. This tariff has dampened the competitiveness of indian products across the global markets.

- U.S.-India trade tensions slowed activity in the indian cash market. Faster selling by Foreign Financial Institutions (FFIs) added pressure. This caused a sharp sell-off in July and August. The weakness in equities weighed on the rupee, adding upside pressure on USD/INR.

- Nifty 50 outlook is optimistic. India’s GDP remains resilient, but risks are looming.

- The performance of the Indian benchmark index Nifty 50 is vital in reflecting the overall economic health. To better understand this, check the Nifty 50 Index Outlook in Q4

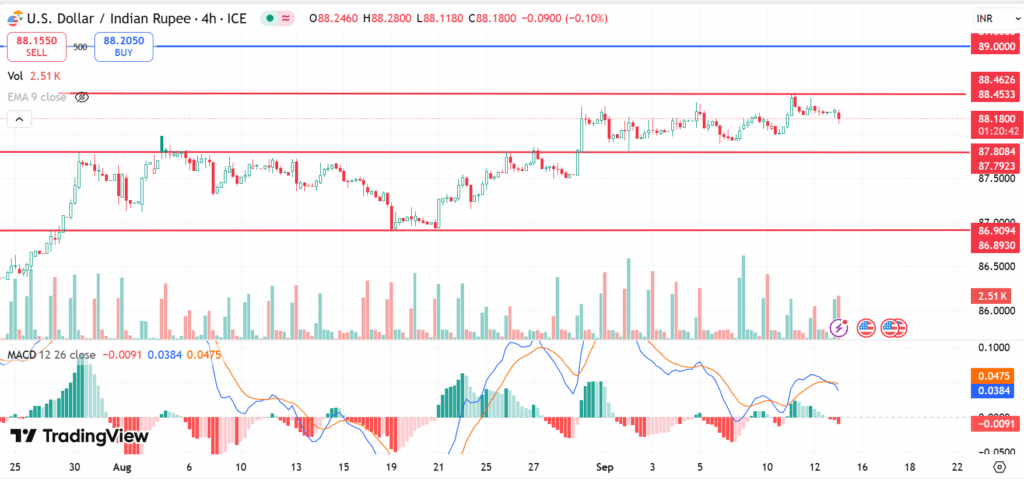

The Technical Outlook for the USD/INR:

From the technical perspective, the bullish scenario remains intact in the near-term trend as the USD/INR holds above the 20-day Moving average at the level of 88.00.

A clear 4-hour close below 88.00 could pave the way toward 87.80, which is a key support level. It’s the low of 25 September, but the currency pair has held steady above this level since that time.

The Relative Strength Index (RSI) holds above the 60.00 mark, which indicates that the bullish momentum remains intact. On the upside, the key resistance level will be at 89.00. Find last week’s analysis here.

The indian Rupee is sensitive to external factors such as the crude oil price, the strength of the US Dollar, and the amount of foreign investment.

India is highly dependent on imported oil, and most of its trades are conducted in USD, so India heavily relies on the US Dollar. The Reserve Bank of India has a direct intervention to keep the exchange rate stable, interest rates, and the monetary policy.

Higher inflation typically requires higher interest rates by the RBI to overcome escalating inflation. A higher interest rate will increase global demand from international investors, which will be positive for the Indian Rupee. Conversely, in a lower inflation environment, the RBI can ease interest rates to encourage local consumption. Inflation increases the cost of exports, leading to more rupees being sold to purchase imports.