The Indian Rupee is back under pressure on today, with USD/INR climbing toward 85.77 as renewed US Dollar demand and foreign equity outflows weigh on the local currency. The pair has extended its recovery after bouncing off 85.00, now trading just below a key resistance zone ahead of Friday’s Reserve Bank of India (RBI) rate decision.

The weakness in INR comes despite better-than-expected economic growth data last quarter. Traders are focused on capital flight, rising oil-related USD demand, and offshore NDF unwinding, all of which have tilted short-term flows in favour of the greenback.

Foreign Outflows and NDF Positioning Shake Up INR

According to market sources, several foreign institutions have been unwinding long rupee positions through the non-deliverable forward (NDF) market, ahead of Friday’s RBI policy meeting, where a 25 basis point rate cut is widely expected.

Meanwhile, equity outflows continue as global funds shift capital back to the US, where yield expectations remain elevated. This has added another layer of pressure on the rupee, which has underperformed most of its Asian peers this year.

Trump’s Tariff Policy and US Deficit Concerns Linger

While the USD remains strong in the near term, sentiment could flip. Concerns over Donald Trump’s aggressive tariff stance and a growing US fiscal deficit, following the House’s passage of a sweeping tax cut, could undermine confidence in the dollar if macro cracks start to show.

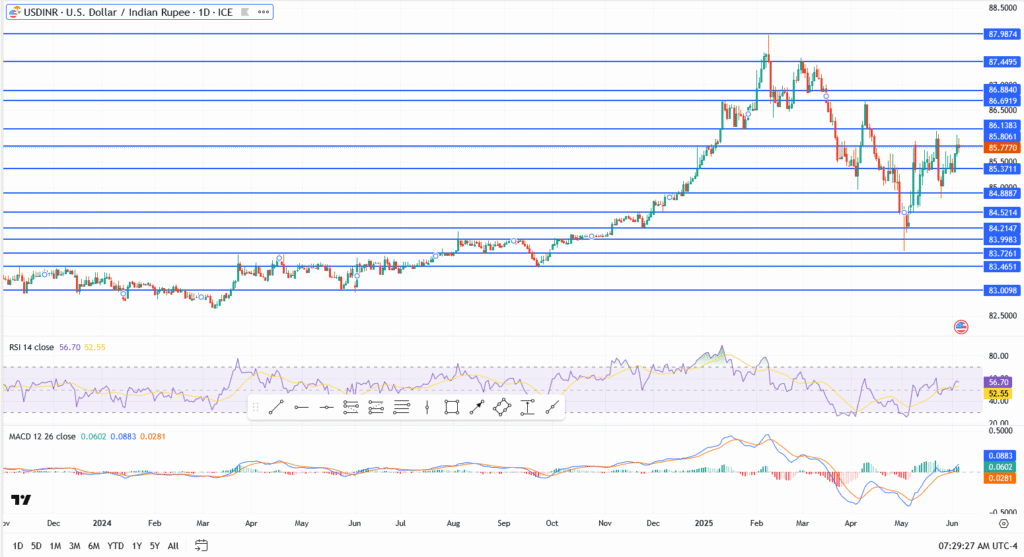

USD/INR Technical Analysis: Bulls Retest Key Zone

- Price has reclaimed the 100-day EMA and is currently testing the 85.80–86.13 resistance range

- Break above 86.13 opens the door to 86.50, then 86.88

- Immediate support lies at 85.30, followed by 85.04 and 84.61

- RSI at 56.70 suggests bullish momentum is building but not yet stretched

- MACD crossover active, with positive histogram extension underway

The setup favors continued upside unless RBI surprises with a hawkish hold or the US data underwhelms significantly. Otherwise, momentum seems tilted toward a retest of April’s 86.71 high.