- Discover the technical analysis for USD/INR amid the Pakistan agreement of ceasefire and how this affects the USINR's volatility, where it goes

Today, Monday, May 15th, most of the asian currencies weakened as the US Dollar gained after Washington announced a trade deal with China. On the other hand, the indian rupee outperformed in response to the news of a ceasefire agreement with Pakistan.

The US Dollar index rose 0.2% in the Asian session today, hovering near its one-month high. The announcement about the U.S. and China trade says that the trade deal had been struck, but they didn’t mention any details bout the deal.

U.S. Treasury Secretary Scott Bessent said that the discussion is “substantial progress,” and Chinese Vice Premier He Lifeng said it’s an “important consensus” was reached. These updates supported the US Dollar and put some currencies under pressure.

Indian Rupee rallies on Pakistan Ceasefire

On Saturday, India and Pakistan reached a ceasefire agreement after being in a heavy way and tension.

USD/INR fell 0.9% today and reached 84.621 rupees.

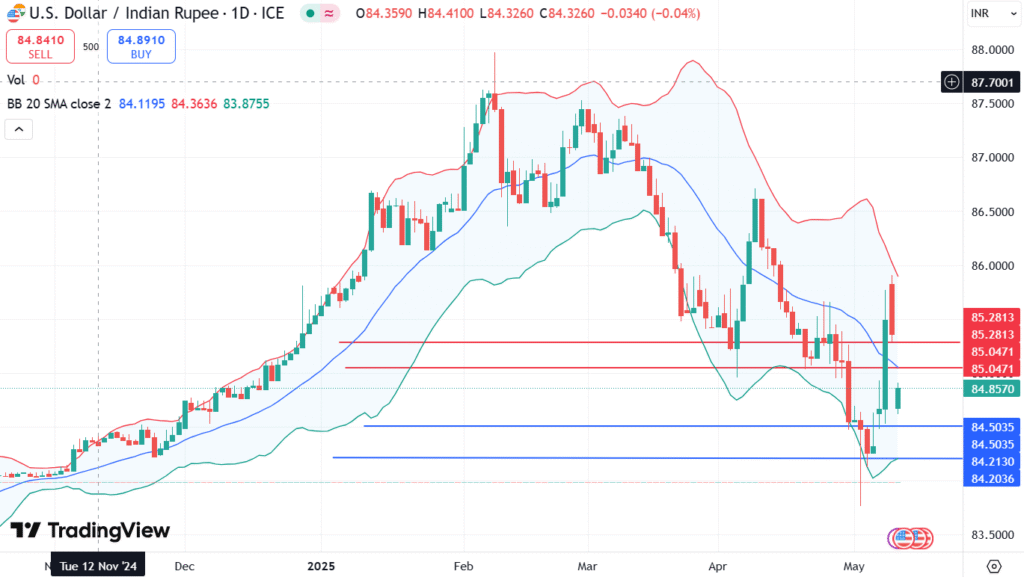

According to the Daily time frame chart, USD/INR is trading at the time of writing, 84.85 rupees. Today, the pair reached a lower level at 84.60. The bearish scenario is highly recommended as long as the USD/INR is under the pressure of the resistance level of 85.047.

Any break under 84.50, which is a good support level, may open the door to reach lower levels, reaching 84.21.

On the flip side, if the USD/INR successfully reaches the resistance level 85.04 and breaks above 85.04, this might push the pair to reach higher levels to 85.28, however, the bearish side is stronger now due to US dollar strength.

Check last week’s technical analysis: USDINR Technical levels amid Geopolitical flare-up

Indian Consumer Price Index release

The rupee is waiting for the release of the consumer price index data later today, and this may affect the volatility somehow because traders use it to expect to which extent may affect the indian monetary policy. The next meeting for the monetary policy committee is scheduled to be from 4th to 6th June,2025.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.