- Delve into the USD/INR technical outlook and understand the factors shaping this currency pair along with the dollar index outlook.

The USD/INR opens today positively by 0.24%. The currency pair is currently trading near 88.11 against the US. The US dollar extends its downside in response to the weakening US official job data.

This article will cover all the key factors influencing the USD/INR currency pair, as well as its technical outlook. We will examine the US Dollar index and address the most frequently asked questions by traders.

USD/INR | The Key Factors Influencing The Rupee Against US Dollar:

- The U.S. dollar is under pressure, facing strong selling momentum in response to the soft US nonfarm payroll (NFP) data.

- A weaker U.S. labor market has led to higher bets on the Federal Reserve cutting interest rates in its next meeting. This may increase pressure on the U.S. dollar and support the indian rupee.

- The NFP report showed that the economy added only 22k workers, which is the worst record since jan 2021.

- According to the Fed Watch tool, there is an 88.4% probability that the Fed will cut rates by 25 basis points. The remaining probability is for a 50 basis point cut, which would bring the rate to 3.75%-4.00%.

- Despite trading higher against the US Dollar on Tuesday, the outlook for the Indian Rupee remains uncertain. Because of the continuous outflow of overseas funds from the indian stock market, along with US-Indian trade tensions.

- Foreign Institutional Investors (FIIs) sold indian equities worth 2,169.35 crores on September 8.

- FFIs have sold indian stocks worth Rs. 7,836.25 crores over the first six trading days of September.

- The indian government has announced a rationalization of the goods and services tax (GST) structure. This aims to boost domestic consumption and offset the impact of US-Indian trade tensions.

- Due to US President Donald Trump’s 50% tariffs, Indian exports to the US in FY2025 represented less than 2% of GDP, but the impact could still be significant on employment and consumption.

- Traders’ focus will be shifted this week toward these critical data :

- US-Producer Price Index (PPI), 10 September.

- US-Consumer Price Index (CPI), 11 September.

- Indian- Consumer Price Index (CPI), 12 September.

- Indian- FX Reserves, USD, 12 September.

- For both nations, inflationary pressures are expected to have grown at a faster pace due to the trade tensions between them.

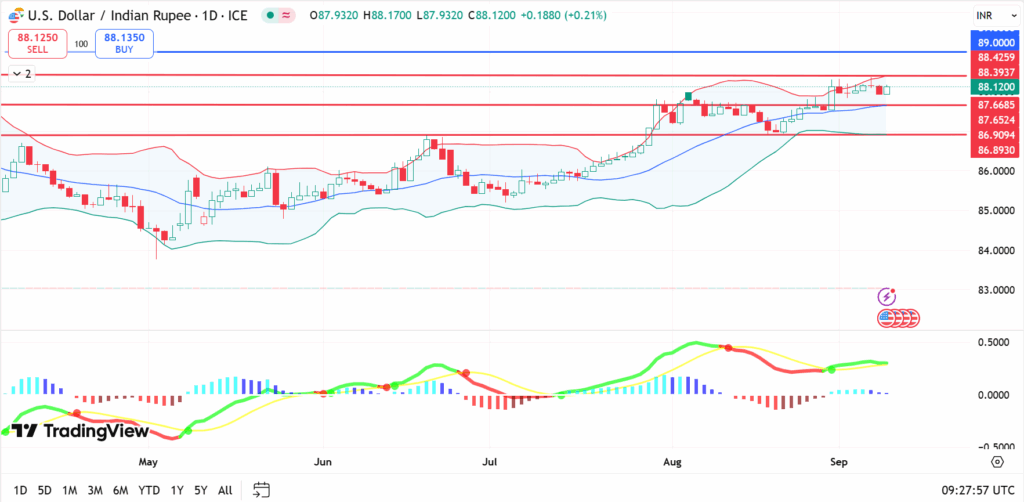

Technical Outlook for The USD/INR Currency Pair:

The USD/INR is trying to consolidate above 88.10, but it’s facing pressure from the resistance level of 88.39 according to the Bollinger Bands indicator. A clear 4-hour close below 88.00 could pave the way to reach lower levels toward the first support level, 87.66, and 86.90, respectively.

A bearish scenario could unfold if the upcoming US data weakens the US Dollar. Moreover, the MACD shows that the bullish momentum on the daily chart has ended without a clear signal. While on the 4-hour time frame, it indicates bearish momentum.

On the other hand, the RSI is hovering around the 60.00 mark, indicating that a fresh bullish momentum could emerge if it holds above that level. The level of 89.00 would be the key resistance for the pair on the Upside. You can look at last week’s analysis from here.

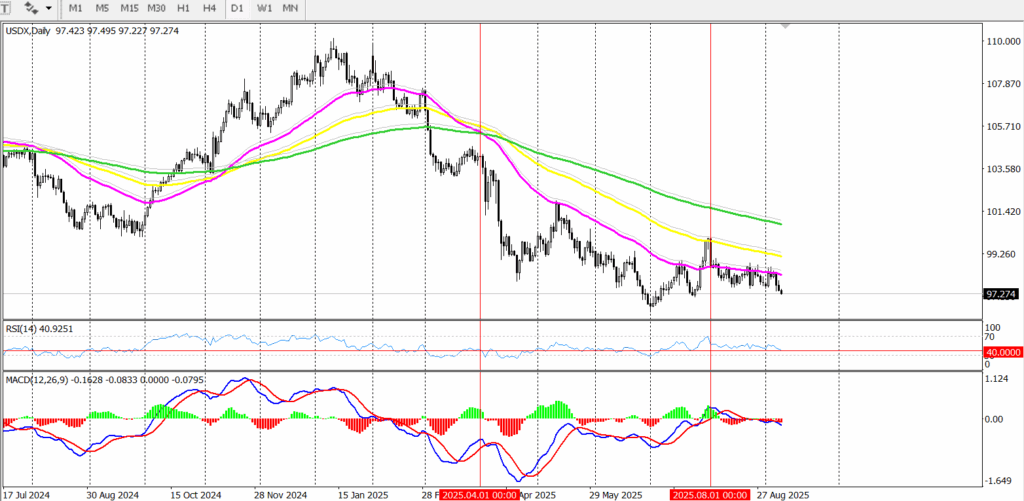

The U.S.Dollar Index Chart:

Looking at the U.S.Dollar Index daily chart, the index has been trading below the 200-day, 100-day, and 50-day moving averages since April 2025 and is currently trading around 97.24, a level not tested since March 2022.

The USD failed to recover and consolidate above the 50-day moving average at the start of August 2025. On August 1, 2025, the Dollar Index gained bullish momentum, reaching 99.98, but failed to break out the 100-day moving average. The MACD on the daily chart indicates bearish momentum, while the RSI is hovering around 40, suggesting that selling pressure remains.

Due to policy uncertainty, Trump’s tariff war, the US-China trade war, and concerns about the independence of the US Federal Reserve.

In the short term, the USD may continue to decline as investors grow more cautious amid geopolitical tensions, redirecting their investments toward safe-haven assets rather than riskier assets like the US Dollar, bonds, and stocks.