- USD/HKD remains one of the lowest volatility FX pairs globally, anchored by Hong Kong's Linked Exchange Rate System and strong institutional credibility.

- Price action continues to be range-bound, with the pair consolidating within the long-standing 7.75 - 7.85 convertibility band and short-term focus on the 7.77 - 7.80 zone.

- Macro forces such as Fed policy and USD liquidity affect short-term fluctuations but are channeled into minor swings rather than sustained trends due to the peg.

[InvestingCube, 7 January 2026] The USD/HKD still retains one of the lowest volatility profiles in global FX, as Hong Kong’s currency regime is supported by a robust institutional framework. At the start of January 2026, USD/HKD is more or less in the 7.78 – 7.79 range, still deep inside this decades-old conversion band. According to data from Yahoo Finance, the 52-week trading range for the pair is very narrow, and this underpins its status as a policy-anchored currency pair rather than a speculative trading instrument.

With Hong Kong operating an independent currency regime, unlike a free-floating FX pair such as EUR/USD or GBP/USD, we rarely see USD/HKD move on trend-following capital flows. Rather, movements are driven by the interaction of policy credibility, access to interbank liquidity, and short-term US dollar fluctuations within a managed exchange-rate framework. Forward analysis is therefore less about the direction of breakout potential and more about a sustainability of range dynamics.

Policy Anchor: Hong Kong’s Linked Exchange Rate System

The single factor that keeps USD/HKD pricing unique is Hong Kong‘s Linked Exchange Rate System (LERS). Under the system the HKMA is committed to keeping the Hong Kong dollar within range of 7.752 7.85 to the US dollar utilizing automatic market operations when there are shortages or surplus of liquidity.

Hong Kong officials have voiced steadfast support for the peg. Hong Kong’s Financial Secretary said in January 2025 that the peg system “is operating impeccably and continues to be at the heart of Hong Kong monetary stability,” further noting that there was no need or plan to adjust the current state of affairs (Source: Reuters). This official position is instrumental in anchoring market expectations and dispelling speculation or positioning against the band.

With this institutional commitment, prolonged deviations from the policy range would be highly unlikely under normal market conditions.

Interventions and Market Discipline

The peg’s incredibility has also been strengthened by actual policy actions. By mid-2025, as USD/HKD was approaching its weak-side convertibility undertaking at 7.85, the HKMA entered the market to buy Hong Kong dollars. These actions were intended “to defend the currency peg and stabilize intervention liquidity,” Reuters reported.

Historically, these interventions did not cause a shift in trends; they are in fact associated with compressing volatility and restoring equilibrium. This again highlights the one-way nature of USD/HKD trading: it is acceptable to trade within the band for short periods of time, but sustained directional pressure tends to trigger a policy response.

Macro Influences: U.S. Dollar and Liquidity Conditions

While the peg still determines pricing in USD/HKD, external macro dynamics can create a short term overhang. Key support comes from a weaker US dollar, as EM currencies tend to perform well on the back of that sentiment, with Fed policy being central to this outlook.

Reuters has reported that the US dollar experienced structural pressure in 2025 amid ebbing inflation momentum and evolving rate-cut expectations. However, given the peg, these forces were channeled into only small swings in USD/HKD rather than long-term trends. USD/HKD is therefore a reflection of liquidity adjustment rather than an expression of broader dollar strength or weakness.

Domestic liquidity conditions, as evidenced by Hong Kong Interbank rate (HIBOR), may also cause USD/HKD to temporarily move slightly above or below the range. However, these shifts are normally self-correcting, as capital flows and HKMA operations help restore balance.

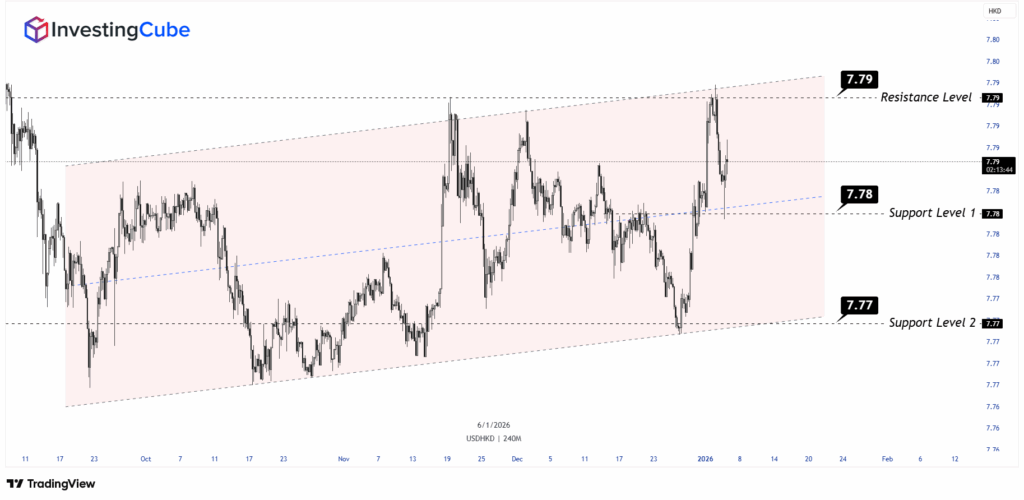

Technical Pattern: Up Channel in a Range-Bound Framework

From a technical standpoint, USD/HKD is still trading within an idling, mildly rising channel as depicted on the 4-hour chart, where the pattern appears to have paused briefly for a consolidation. The nearby level around 7.79 has capped upside attempts in the recent past, establishing itself as an obvious near-term resistance area. Meanwhile, the 7.78 area acts as a mid-level pivot, often serving as a mean-reversion point for intraday and short-term price reactions.

Support around 7.77 coincides with the lower boundary of the channel and former reaction lows, providing additional structural support. The recent move up from 7.77 to 7.79 highlights the pair’s strong mean-reverting characteristics, a defining feature of policy-managed currency regimes. When upward momentum develops, gains are typically constrained by the intersection of resistance and politic authority .

Outlook and Risk Assessment

Going forward, the base case is a continuation of consolidation within the 7.77 – 7.80 bracket, assuming no extreme surprises occurring the coming week. Forecast published by analytical websites such as StockInvest and CoinCodex suggest minimal movement over the next few months.

The key areas to watch are less about the emergence of a trend and more about potential stress signals, including:

- Rapid shifts in expectations surrounding Federal Reserve policy

- Rapid changes in interbank liquidity within the Hong Kong market

- Severe global risk-off events, with capital flows under significant pressure (low probability)

Otherwise USD/HKD is likely to remain a stable, range-trading, and policy-anchored one-way market, maintaining its defensive heart currency, low-volatility profile rather than evolving into a directional story.