- US crude oil inventories rose more than expected, keeping oil prices under pressure.

- Easing fears of US military action against Iran reduced geopolitical risk premiums.

- Lower oil prices may limit Canadian dollar strength, supporting USD/CAD in the near term.

USD/CAD pair advances 0.13%, and edges higher for the sixth straight day, trading around 1.3892. The Canadian dollar strengthened quietly against the US dollar as oil prices rose. The Canadian economic calendar is moderate, but it includes important upcoming indicators.

This article examines the key factors shaping USD/CAD pricing, including the price performance of crude oil and its impact on the Canadian dollar, as well as a technical outlook for the pair.

The Fundamental Forces Behind USD/CAD Moves:

All eyes are on the upcoming Federal Reserve decision on 28 January regarding interest rates. According to the CME FedWatch tool, a 96.6% probability that the interest rate will be unchanged in the range of 3.50%-3.75%.

This high percentage of probability is due to the release of the United States consumer price index data for December, which showed that price pressures grew steadily. On the other hand, the Canadian dollar remains weak due to the weakening job market conditions in Canada.

With that, market participants are expecting that the Bank of Canada (BOC) may cut interest rates in the near term. Canadian statistics released last week showed that the Unemployment rate increased significantly to 6.8% in December from the previous reading of 6.5%. The rising Canadian jobless rate has been the major drag on the Canadian dollar. Traders are watching this week’s Canadian macroeconomic releases, with housing starts on Friday in focus.

Crude Oil Weakens as Iran Tensions Ease, Pressuring the Canadian Dollar:

Since the Canadian dollar is closely tied to oil prices, softer crude may limit CAD strength, offering near-term support to USD/CAD. WTI Oil price lost its gains and remains under pressure, trading around $59.00, dropping from the $60.00 level. Easing of fears of a US military strike on Iran is keeping crude oil prices range-bound. Brent Crude Oil Forecasts 2026

Oil Market Developments Impacting the Canadian Dollar:

- According to Reuters, US President Donald Trump said reports signal that Iran’s crackdown-related killings are easing.

- Trump didn’t rule out US military action but said that Washington is closely monitoring the situation.

- A larger-than-expected increase in US crude oil inventories reinforced bearish sentiment. The US crude stockpiles rose by 3.39 million barrels last week compared with expectations of a 2.2 million-barrel draw.

- Oil prices remain under pressure as rising inventories weigh on the market.

- Kikukawa expects WTI crude to trade in a $55–$65 range in the near term, despite ongoing geopolitical risks.

Lower oil prices tend to weaken the Canadian dollar, as Canada is a major oil exporter and energy revenues play a key role in its economy. Rising US crude inventories and easing geopolitical risks are keeping oil under pressure, limiting CAD strength. As a result, USD/CAD may find support and remain biased to the upside in the near term.

The Technical Outlook for the USD/CAD:

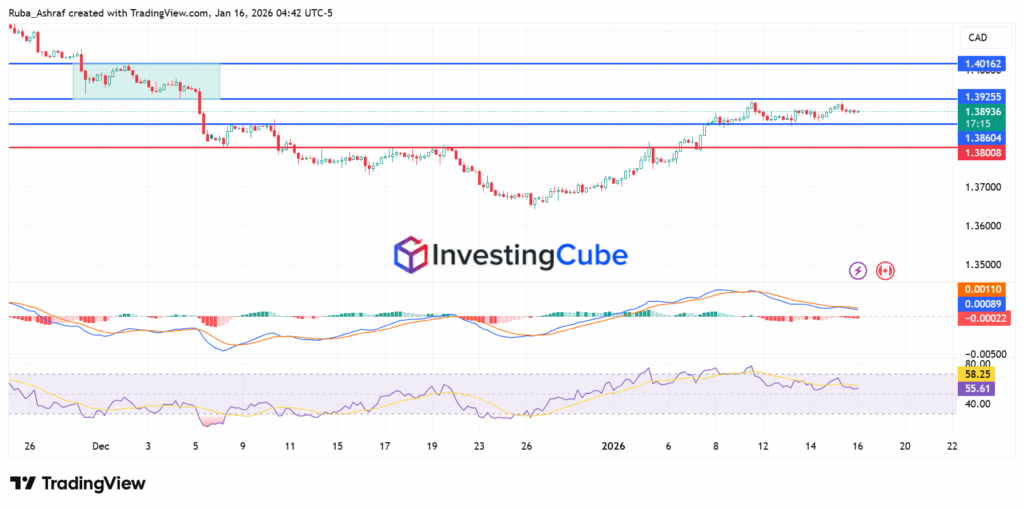

The USD/CAD price action shows that it has moved below a clearly defined rectangle resistance zone that was highlighted earlier on the chart.

This rectangle represents a former consolidation and supply area, and trading below it suggests that USD/CAD has been under pressure. At that time, sellers were defending this zone and limiting upside attempts.

Recently, price managed to break above the lower boundary of the rectangle, signaling a shift away from direct selling pressure. However, this move doesn’t yet confirm a full bullish breakout. Instead, it points to a consolidation phase, where the pair stabilizes and builds momentum, testing the strength of overhead resistance within the rectangle range.

A decisive break above the upper boundary of the rectangle range would be technically significant. Such a move would indicate that buyers have absorbed selling pressure. It potentially triggers renewed bullish momentum and opens the door for USD/CAD to advance toward higher resistance levels.

Until then, price action within and below this zone suggests cautious optimism rather than a confirmed trend reversal. The MACD shows fading bullish momentum, suggesting consolidation rather than a strong trend at this stage. The RSI is hovering near the mid-50 zone, indicating neutral momentum. It means that buyer and seller power are equal, suggesting a consolidation phase ahead of a potential breakout.

Higher oil prices tend to strengthen the Canadian dollar, which in turn pushes the USD/CAD lower and vice versa.

Canada is a major oil exporter, so changes in oil prices directly impact Canada’s trade balance and currency demand.