- Explore the economic and geopolitical factors influencing the GBP/JPY exchange rate, along with a detailed technical outlook.

Mixed events are going on and pressuring the GBP/JPY currency pair. Starting from the macroeconomic releases, the Bank of Japan’s interest rate bets are in focus. The less dovish Bank of England messages may support the British Pound and the GBP/JPY across.

Looking forward, the UK economy calendar doesn’t wait for any new releases, leaving spot prices at the mercy of the JPY. Meanwhile, the escalating tensions between China and Japan are influencing the pricing of GBP/JPY. The China–Japan trade war benefits the Japanese yen due to its safe-haven status, which in turn weighs on the GBP/JPY pair.

This article examines the economic and geopolitical factors driving the GBP/JPY exchange rate and provides an overview of the pair’s technical outlook.

Economic and Geopolitical Developments Shaping GBP/JPY

Key Geopolitical Developments:

- Over the last weekend, the US military attacked Venezuela and captured President Nicolas Maduro and his wife. This move marks a major escalation in US-Venezuela tensions and raises uncertainty sentiment.

- Moreover, Trump has said that he is planning to control Venezuela’s oil sales. It seems that Venezuela is not the only country wanted by Trump, as he signaled that he can take control of Greenland, Denmark.

- Denmark and Greenland are seeking a meeting with the U.S. Secretary of State Marco Rubio, as the Trump administration doubled down their interest in taking over the strategic Arctic island, a Danish territory.

- On the other hand, China-Tokyo tensions are escalating. China has imposed export restrictions on dual goods to Japan. China takes this move due to the Japanese Prime Minister Sanae Takaichi, who warned last year that Tokyo could intervene militarily if China attacked Taiwan.

- Japanese stock markets got sensitive to these tensions, with downward pressure on the benchmark Nekkai index. Meanwhile, the Japanese yen got supported as it is considered a safe-haven currency amid the escalating dispute.

- China conducted military drills simulating a blockade of Taiwan, signaling rising tensions in the region.

Economic Data and Policy Updates:

- The rising bets on further policy tightening by the Bank of Japan (BOJ) boost the Japanese yen. The Bank of Japan raised the interest rate to 0.75% in December 2025. This raise is the highest in 30 years. The upcoming meeting is scheduled for Jan 22-23,2026. Interest rates will likely be raised, as signaled by the Bank of Japan governor. He previously stated that the central bank will continue to raise rates if economic and price developments align with forecasts.

- On the other hand, the Bank of England is signaling that rates are nearing neutral. Thereby, the British Pound and GBP/JPY may continue to find support.

With the geopolitical and economic updates reviewed, let’s examine how these developments are influencing GBP/JPY and explore the potential technical scenarios.

The Technical Outlook for GBP/JPY

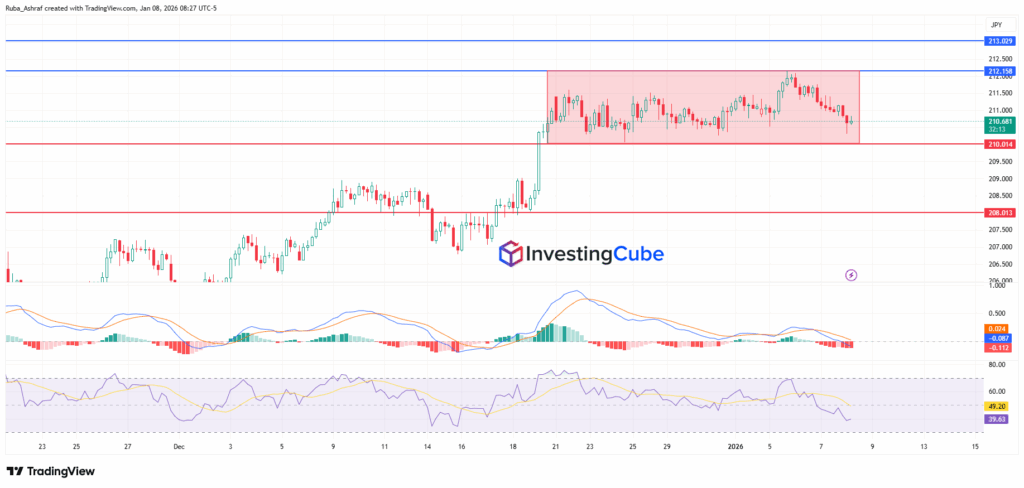

Price action shows that GBP/JPY is moving sideways within a tight range. The pair successfully broke above 210.01 on December 25, 2025, and has since consolidated above this level. It attempted to break above the 212.15 region, the highest level since August 2008, on Tuesday, but failed to do so due to geopolitical tensions.

The MACD momentum signals that bullish momentum is over, and a correction begins. Meanwhile, the RSI has dropped below the 50 level and is trending toward mid-30s. It indicates soft momentum but is not yet oversold.

The immediate support stands at 210.01. A clear daily close below this level could pave the way toward the next support at 208.01. Immediate resistance is located at 212.15, the highest level since March 2008. A decisive breakout above 212.15 would signal renewed buyer strength, paving the way toward 213.03.

It marks a major long-term resistance level, and a break above it could signal renewed bullish momentum.

Monetary policy signals from the Bank of England and the Bank of Japan, along with inflation and growth outlooks, are key drivers.