- USD/INR rose to all-time highs of 90.44 on Thursday, with the Reserve Bank of India cutting repo rates by 25 basis points.

- The Federal Reserve is expected to cut interest rate in its December 9-10 FOMC meeting.

- Outflows from India's Foreign Institutional Investors (FII) have topped $17 billion Year-to-date, adding pressure on the rupee

The currency market has been shaky lately. The USD/INR pair hit a new high on Thursday, going to ₹90.44 per dollar. This jump was caused by foreign investors selling off over $17 billion this year and importers needing dollars, which has made people nervous. Now, two major central bank decisions are coming up.

This surge comes at a pivotal moment, as central banks on both sides of the equation adjust their policies. Let us explore what this means for traders and investors watching the pair closely.

Central Bank Actions in Focus

The Reserve Bank of India (RBI) announced on December 5, 2025, that it was changing its money policy. The Monetary Policy Committee (MPC) voted to lower the repo rate by 25 points to 5.25 percent. Governor Sanjay Malhotra said this was the fourth rate cut in 2025, designed to help the economy grow.

In the United States, the Federal Reserve is expected to do something similar. A Reuters poll of over 100 economists shows that 82 percent think there will be a 25-point cut at the December 9-10 Federal Open Market Committee (FOMC) meeting. Traders believe there’s an 87.6 percent chance of this happening, highlighting the market’s conviction despite internal debates.

How will Fed and RBI Cuts Impact USDINR Pair?

All things considered, the USD/INR pair is facing a difficult time. The RBI’s rate cut, while meant to help the economy, hasn’t stopped the rupee from falling. This is partly because people think the Fed will also make cuts, which could make the difference in returns between the two countries smaller. If the Fed delivers the anticipated cut next week, as projected by BofA Global Research, the dollar may soften globally, offering some relief to emerging market currencies like the rupee.

The net outcome will hinge on the relative magnitude and market perception of these two events, as well as the prevailing domestic factors. If the Fed cuts rates more than expected or gives a clear sign that they will keep rates low, the weakening dollar could outweigh the problems caused by the RBI’s cut. This could cause a temporary drop for the USD/INR. The exchange rate’s reaction will be closely watched as traders gauge long-term impacts and adjust their positions.

USD/INR Forecast

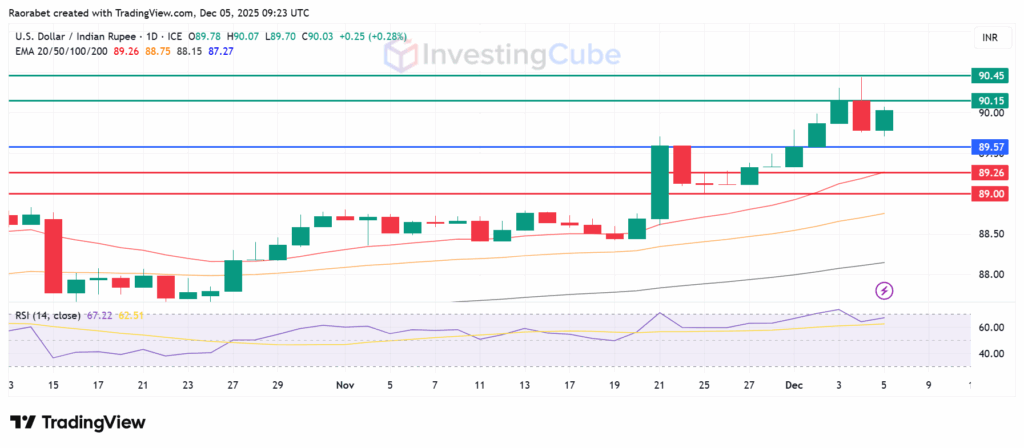

The USD/INR pair is showing a strong upwards trend on the daily charts. The Relative Strength Index (RSI) is at 67, meaning it’s getting close to being overbought (above 70). But it also shows that there’s still a lot of buying going on, and a change isn’t likely to happen soon. Investors should be watchful since high RSI values can be signals of a possible price correction.

The pair is facing resistance at the psychological 90.00, which is a level that was tested recently. If it breaks through this, it could go up to 90.15, and a stronger momentum could extend gains to break the current ATH and test 90.45. On the other hand, there’s support at 89.20, which lines up with the 20-day EMA. If the price falls, buyers might step in around this level. If it falls further to 89.00, the upwards trend could be in trouble.

USD/INR trading pair on December 5, 2025, with key support and resistance levels. Created on: TradingView

The main reasons were continuous selling by foreign investors, totaling over $17 billion so far this year. Also, importers’ increased need for dollars in India put strain on the foreign exchange market, causing an imbalance between supply and demand.

A Fed rate cut should make the rupee stronger, lowering the USD/INR value. This is because lower US interest rates weaken the dollar worldwide, prompting money to leave dollar investments and return to riskier markets like India.

The key psychological level recently surpassed is ₹90.00, which had been acting as a major resistance level.