- The GBP/PLN forecasts for 2026 will be decided by the rate-cut differentials between the BoE and the NBP.

The GBP/PLN exchange rate today is the 4.8672 closing price of mid-January 2026. This keeps the currency within the weekly range, bordered by the 4.84 and 4.87 price levels. Starting points for this currency pair’s pricing helps readers understand the extent to which the GBP/PLN forecasts will play out. The end-2026 target will be a function of rate-cut differentials between the BoE and NBP.

By rate cut differentials, we mean the differential between the scale and aggressiveness with which each central bank cuts rates. The bank that delivers a more aggressive easing pathway will invariably weaken its currency against the other.

GBP/PLN Live Chart

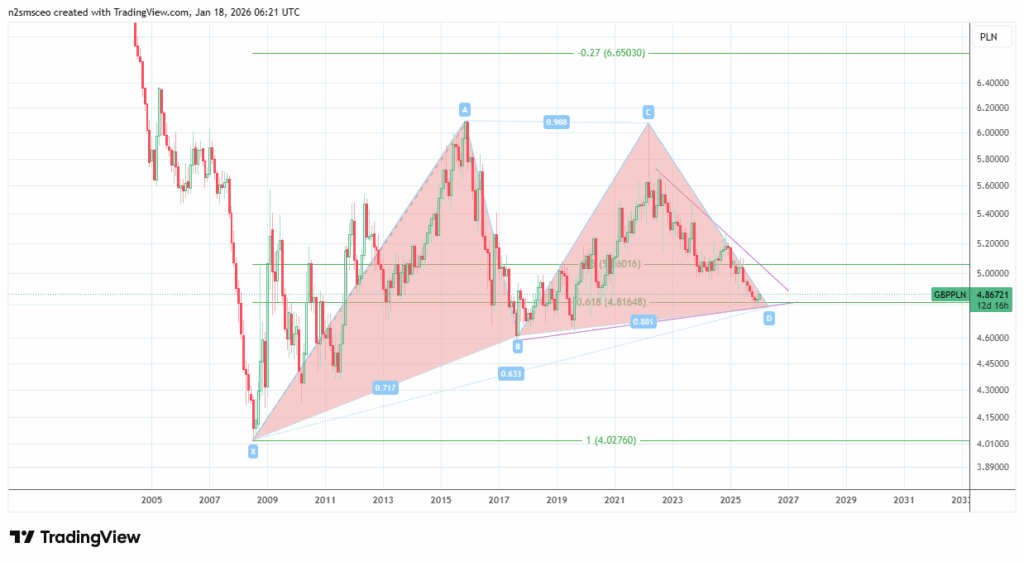

The GBP/PLN has been in a downtrend since March 2022, which may influence trading strategies by indicating potential short-term bearish opportunities. March 2022’s monthly pinbar candle indicated a firm rejection at a lower high than the December 2015 bearish candle, suggesting a shift in market bias towards the Zloty. The subsequent downside move was cemented by a bearish pennant, allowing for continuation from the November 2024 pinbar candle onto the 4.8164 price mark. This price mark is the 61.8% Fibonacci retracement level of the long-term July 2008 – December 2015 upswing.

The bounce from this retracement level also coincided with a support bounce from the trendline that encompassed prior lows in August 2017 and September 2019. Understanding the significance of the 61.8% Fibonacci retracement level helps in assessing potential reversal zones and future market movements. Given the sentiment of institutional favouring GBP/PLN easing in 2026, the butterfly pattern on the long-term monthly chart points to long-term easing. However, there are many short-term and medium-term support/resistance price points to navigate within the context of the GBP/PLN forecasts for 2026.

GBP/PLN Forecasts for 2026: Fundamental Drivers

The macro drivers for the 2026 GBP/PLN forecasts are as follows:

- BoE easing pathway

- UK growth data volatility

- NBP policy amid Poland’s disinflation trend

- Polish inflation expectations

- Regional beta/risk sentiment

1. BoE Easing Pathway

Weak labour data and falling inflation in the UK in 2025 opened the door for further easing with a 25 bps rate cut to %, along with a more bearish vote from the Monetary Policy Committee (MPC) in November 2025. BoE policymaker Alan Taylor has explicitly hinted that UK interest rates would fall further in 2026, as inflation was cooling faster than previously expected. If the BoE adopts a faster easing pace, this would be negative for the Pound versus the Zloty and other CEE currencies.

2. UK Growth Data Volatility

November’s UK GDP data surprised to the upside. Despite greater sensitivity of the GBP to inflation and UK employment data, any GDP surprises could impact GBP/PLN forecasts, even if the impact is likely to be transient and deliver less volatility than the aforementioned fundamentals.

3. NBP Policy and Poland’s Disinflation

2025 was a year when the NBP explicitly ruled out rate cuts due to persistent inflation. This guidance kept the NBP’s reference rate at 4.00%. Analysts polled by ING expect the easing cycle to resume in 2026 with multiple rate cuts, with an end-2026 target of 3.25%.a

4. Polish Inflation Expectations

December 2025 Polish inflation cooled to 2.4%, with the NBP now more confident it can keep inflation within its target range. Commentary from the NBP as Polish inflation expectations evolve will be a key driver of the PLN’s value in 2026.

5.Risk sentiment

The Zloty, like the Czech Koruna and other CEE currencies, is a regional beta currency that performs better in a risk-on environment. A calmer geopolitical climate and stable EU growth characterise this risk-on environment. However, risk-off factors such as energy shocks, stock market selloffs, and emerging geopolitical risks can cause a rapid weakening of the Zloty. Therefore, the GBP/PLN forecasts for 2026 will continue to be shaped by CEE risk premiums and the UK interest rate picture.

GBP/PLN Forecasts for 2026: Institutional Targets

A summary of ING’s institutional targets indicates that sentiment favours GBP/PLN weakening in 2026. The three-, six-, and nine-month targets are 4.81, 4.76, and 4.69, respectively. These targets are derived from an implied pathway based on the EUR/PLN and EUR/GBP crosses. This outlook is consistent with the market bias of relatively limited PLN downside, with a much softer Pound versus European FX.

GBP/PLN Technical Outlook

The double bounce on the 4.7703 support and the butterfly pattern’s trendline form an evolving double bottom, with a neckline at the 4.8728 resistance (weekly resistance). This barrier must be uncapped for pattern confirmation, with 4.9577 (the April/May 2024 lows and July 2025 high) as the measured move’s target. Above this level, additional resistance lies at the 5.0600 – 5.1010 price zone.

On the flip side, the bears would be seeking a breakdown of 4.7703 to continue the institutionally predicted downtrend move. This move will require a breakdown of the 4.8171 intermediate support shoulders (October 2024 and January 2026 lows), targeting the August 2018/January 2019 lows at 4.6993 and potentially the August 2017 low at 4.5832.

FAQ

What is the current price of the GBP/PLN?

The closing price of the GBP/PLN as of Friday 16 January 2026 was 4.8634.

What currency does “PLN” stand for?

The PLN is the symbol for the Polish Zloty.

What are the GBP/PLN forecasts as put out by banks and sell-side firms?

The projection from ING’s analysts’ summary is for a gradual easing of the GBP/PLN towards the 4.69 price area, if the rate-cut differentials between the Bank of England and Polish Central Bank play out as projected.