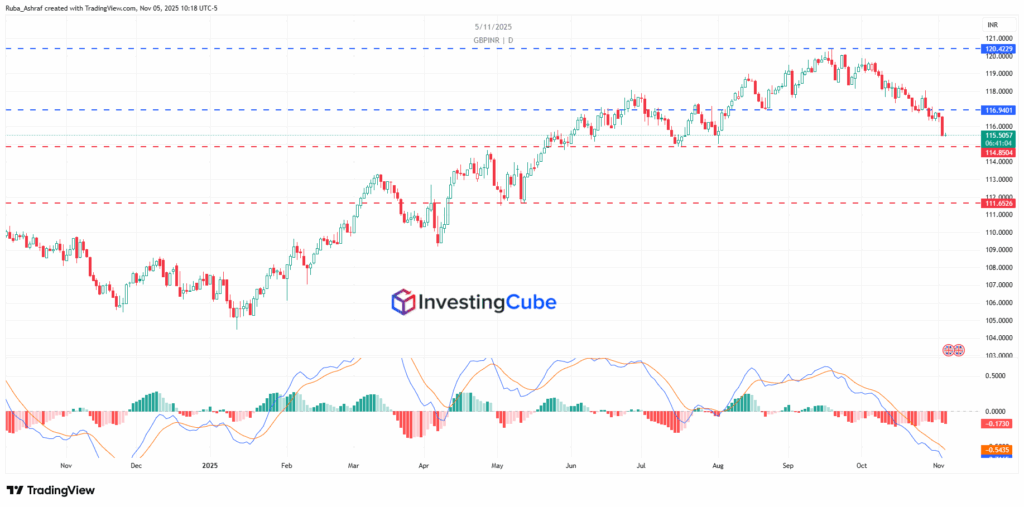

- GBP/INR remains under pressure below the key resistance level of 116.94, showing limited upside momentum.

- A clear break below 114.85 could trigger further downside toward 113.00 and 111.65.

- Strong UK data and softer Indian inflation could support a rebound toward 120.42 if resistance is breached.

- Select 54 more words to run Humanizer.

The GBP/INR is searching for a floor to recover from its heavy decline. The British pound declined to its 7-month low. The US Dollar Index continues to add strength near a three-month high. This is in response to what Jerpm Powell indicated: that it may be the last interest rate reduction of the year.

The dollar index is quoted at 100.30, rising by 0.07% at the time of writing. The GBP/USD is trying to find a floor and currently trades around 1.3024, advancing by 0.01% on the day. On the other hand, it’s declining by around 2.82% a month.

The British currency is trading cautiously due to dovish expectations from the BOE. These expectations came from the softer-than-expected UK consumer price index as seen in September. Its figures indicate that the labor demand is moderate compared to the employment data for the three months ending in August.

The BOE interest policy will be announced on Thursday. Meanwhile, the UK Manufacturing Purchasing Managers’ Index was released last Monday, rising to a 12-month high of 49.7 in October, up from 46.2 in September.

The Reserve Bank of India announced that it will keep the repo rates unchanged at 5.50% with a neutral stance. The GBP/INR futures are trading at approximately 115.53, as traders are cautious due to mixed sentiment in the markets.

The Key Fundamental Factors Influencing the GBP/INR:

- The upcoming BOE interest rate decision on Thursday:

If the Bank of England keeps interest rates unchanged, this will be higher relative to the Reserve Bank of India. This can strengthen the British Pound and weigh on the indian rupee. In this case, we may see the GBP/INR go up. - Inflation and Economic Growth in the UK and India:

The higher inflation rate in India, weakening the INR and driving the GBP/INR higher. The expected growth in the UK, as reflected by the PMI figures, can bolster the pound and thereby support a higher GBP/INR. - India’s trade deficit puts pressure on the Rupee, which can push the GBP/INR up.

- On the UK side, the uncertainty comes from trade disruption, tariffs, or risk-related Brexit could weigh on the pound in the case of any escalation.

- Oil price swings can impact the indian rupee by increasing its import bill, thereby indirectly affecting GBP/INR.

The Technical Outlook for the GBP/INR:

The GBP/INR is trading under pressure below the resistance level of 116.94. A clear daily close below the support level of 114.85 could pave the way toward 113.00, and further weakness could extend the decline toward 111.65.

On the upside, if the pair manages to hold above 114.85 and breaks decisively above 116.94, it could open the path toward the next resistance at 120.42, followed by 121.00.

The currency pair faces pressure due to a stronger US Dollar, global risk aversion, and cautious sentiment toward emerging markets. Weak UK economic data and India’s stable macro environment also cap pound gains against the Indian Rupee.

With the support of improved UK data, the probability of the UK interest rate remaining unchanged or a hawkish monetary policy stance, and softer Indian inflation prompting expectations of RBI rate cuts, the GBP/INR could break above the 116.94 resistance and rise toward 120.42.