- EUR/USD ends 2025 near 1.18 after a strong rally, supported by Eurozone growth and dollar weakness, with markets watching key technical levels into 2026.

The EUR/USD exchange rate is closing 2025 near 1.18, marking one of its strongest annual performances in more than a decade as broad US dollar weakness and improving Eurozone fundamentals reshaped currency markets.

After starting the year close to 1.04, the euro has gained roughly 14% against the dollar, driven less by interest-rate differentials and more by concerns over US policy credibility, political risk, and shifting global capital flows.

The dollar’s traditional support from higher US yields faded through 2025 as markets began to price in a structurally more dovish Federal Reserve and rising political influence over monetary policy.

Why EUR/USD Rose Sharply in 2025

One of the defining features of 2025 was the breakdown of the usual relationship between short-term interest rates and the dollar. While the European Central Bank cut rates multiple times during the year, the euro still strengthened.

At the same time, the Federal Reserve held rates higher for longer before delivering rate cuts in the second half of the year. Despite this, the dollar weakened as investors focused on broader risks rather than yield alone.

Bloomberg and Reuters both highlighted rising concerns over US fiscal policy, trade tensions, and the possibility of increased political interference at the Fed, especially ahead of a new chair appointment expected in mid-2026.

US Political Risk and Fed Uncertainty Weigh on the Dollar

US President Donald Trump’s renewed pressure on the Federal Reserve to cut rates more aggressively added volatility to currency markets. Reuters reported that Trump’s public criticism of Fed Chair Jerome Powell, alongside the appointment of known rate-cut advocates to advisory roles, raised questions about the long-term independence of US monetary policy.

Markets also reacted to aggressive US tariff actions earlier in the year, which briefly escalated into a renewed trade confrontation with China. Although a truce later stabilised sentiment, confidence in the dollar remained fragile.

Fears that global institutions could reduce exposure to US assets played a role in sustained dollar selling through the year.

Why Improving Eurozone Economic Data Is Supporting the Euro

While the dollar struggled, the euro found support from improving regional fundamentals. Lower energy prices boosted the Eurozone’s terms of trade, while expectations of a German fiscal expansion helped underpin growth prospects.

At its December meeting, the ECB revised its GDP growth forecasts higher, a move that analysts said reinforced confidence in the single currency. Trading Economics data also showed inflation stabilising across key Eurozone economies, reducing pressure for further aggressive easing.

These factors helped the euro hold gains even as global risk sentiment fluctuated.

EUR/USD Forecast for 2026: What Banks Are Saying

Looking ahead, banks remain cautiously constructive on EUR/USD.

Danske Bank expects further euro gains over the medium term, citing narrowing real-rate differentials, recovering European asset markets, and fading demand for restrictive US monetary policy. The bank maintains a 12-month EUR/USD forecast of around 1.23.

Consensus forecasts tracked by Reuters point to more modest gains toward 1.20, reflecting expectations that US rate cuts in 2026 could further erode dollar support.

However, analysts caution that volatility may increase if US political risk intensifies or global growth slows more sharply than expected.

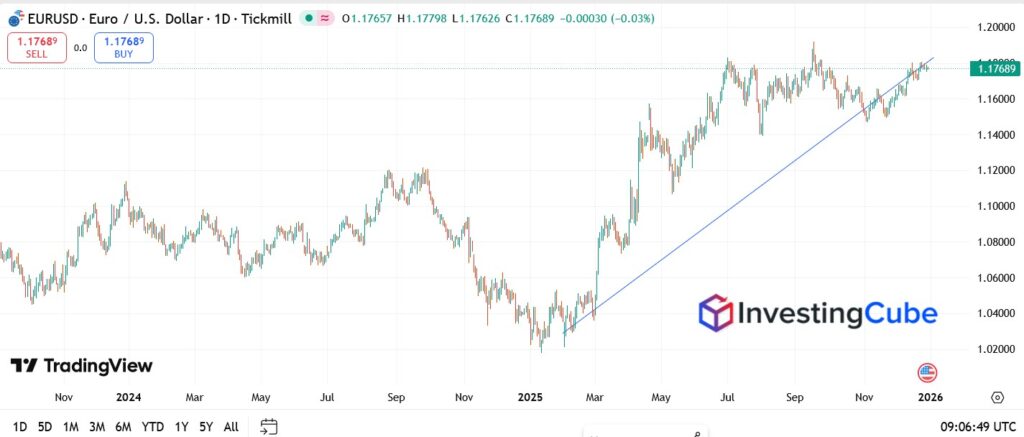

From a technical perspective, EUR/USD remains near the upper end of its 2025 range, supported by a well-defined ascending trendline.

EUR/USD Technical Levels to Watch

Resistance: 1.1800, 1.1890, 1.2000

Support: 1.1720 (trend support), 1.1630, 1.1570

A sustained break above the 1.19–1.20 zone would reinforce the bullish outlook into 2026. However, a decisive move below 1.16 would signal a trend break and open the door to a deeper correction.

Bottom Line: EUR/USD Ends 2025 With Momentum

EUR/USD’s strong performance in 2025 reflects a structural shift rather than a short-term trade. Dollar weakness driven by political uncertainty, fading yield support, and expectations of a more dovish Fed has combined with improving Eurozone fundamentals to lift the euro sharply.

As markets move into 2026, the key question is whether these forces persist or whether renewed confidence in US policy can stabilise the dollar. For now, the balance of risks remains tilted in favour of the euro.

EUR/USD rose due to broad US dollar weakness, political risk in the US, and improving confidence in Eurozone economic fundamentals.

Banks expect further gains if US rate cuts continue and policy uncertainty persists, though volatility is likely to remain high.

Forecasts range from 1.20 to 1.23 over the next 12 months, according to major banks and market consensus.