- The EURUSD pair rose to the highest level since September as traders reacted to Biden victory. Here are the key levels traders will be watching next

The EURUSD pair is up for the fifth consecutive days as traders refocus on the new policies in the United States. It is trading at 1.1890, which is just ten pips below the important psychological level of 1.1900.

The biggest focus in the market is in the United States, where Joe Biden emerged victorious in the highly-contested election. In a speech on Saturday, the president-elect pledged to unify the country by prioritising on key issues to grow the economy.

However, the president-elect faces a major hurdle in achieving this agenda. Analysts are predicting that Republicans will retain control of the senate, which will possibly derail some parts of his policies. That includes raising taxes and unveiling a major infrastructure policy.

Looking ahead, the EURUSD will react to a speech by Christine Lagarde today ahead of the European Central Bank (ECB) annual forum. In this forum, she will address the policy frameworks that the Fed will take as the European Union continues to face significant challenges. The forum will also be addressed by other key central bank governors like Jerome Powell and Andrew Bailey.

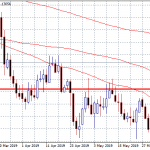

EURUSD technical outlook

On the daily chart, we see that the EURUSD pair has been on an upward trend since Wednesday, when it dropped to a low of 1.1600. Today, the pair is trading at the highest point it has been since September 10. It has also moved above the 15-day and 25-day moving averages, which is an indication that bulls have prevailed.

Therefore, I suspect that the bullish trend will continue as bulls aim for the next resistance level at 1.2000, which is the year-to-date high. On the flip side, a move below the psychological level at 1.1800 will invalidate this trend.