- EURUSD is under selling pressure ahead of the US NFP report following the disappointing industrial production reports from Germany and France.

EURUSD is under selling pressure today following the roster of negative data from euro zone. The currency pair’s initial fall was brought about by disappointing German data. According to Destatis, German industrial production contracted by 3.5% in December. It was bigger than the 0.2% fall that analysts had predicted. On the brighter side of things, Germany’s trade balance report topped expectations at 19.2 billion EUR. It was higher than the 16.4 billion EUR trade surplus that was anticipated.

However, a few minutes later, data from the euro zone’s second-largest economy exacerbated the slide in EURUSD. French industrial production for the same month declined by 2.8% and missed the -0.3%. Just like Germany, its trade balance report came in better than expected. The forecast was for a trade deficit of 5.1 billion EUR but it printed at -4.1 billion EUR.

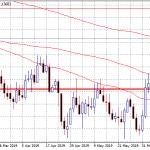

Consequently, EURUSD is trading at its 4-month lows around 1.0960.

Read our Best Trading Ideas for 2020.

The US NFP report is due later today at 1:30 pm GMT. The forecast is for job growth amounting to 163,000 and for the unemployment rate to come in at 3.5%. Meanwhile, average hourly earnings is seen at 0.3%.

Positive figures could probably fuel the drop on EURUSD even further. The next support level is around 1.0890 where it bottomed on September 2019. On the other hand, better-than-expected figures could help the currency pair climb its way back to 1.1000 where it previously found support.