- EURUSD continue lower for the second consecutive session as the risk-off sentiment returns to market after the rising number of new coronavirus infections

EURUSD continue lower for the second consecutive session as the risk-off sentiment returns to market after the rising number of new coronavirus infections in California, Arizona and Texas. The correction from three-month highs continue, but bears would need much more steam to push the pair lower. The 1.12 mark has proved strong support the previous week.

The German GfK institute announced that the consumer sentiment index improved to -9.6 for July topping the expectations of -12. The May reading was at -18.6.

Yesterday, the IFO Institute reported that business expectations increased to 91.4 from previous 80.5. The current assessment of the economy came in at 86.2 from the previous 78.9. The business climate for June increased from 79.7 to 86.2.

Euro supported by the proposed €750bn coronavirus recovery fund. The recovery fund is designed to finance grants and loans to EU members to offset the coronavirus recession.

Download our Q2 Market Global Market Outlook

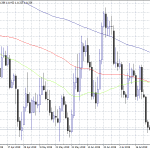

EURUSD Price Daily Technical Analysis

EURUSD is 0.14% lower at 1.1233 with sellers continue to push lower keeping the correction wave from three-month highs alive. The technical outlook remains bullish for the EURUSD pair as long as the pair stays above the major daily moving averages.

On the downside, initial support for the EURUSD stands at 1.1223 the daily low. Next support area would be met at 1.12 round figure and then at 1.1171 the low from June 22. If the EURUSD breaks that support, then the next target for bears is at 1.1114 the low from June 2 trading session.

On the flip side, first resistance for EURUSD stands at 1.1259 the daily high. If the pair breaks that resistance, then the next hurdle is at 1.1325 the high from yesterday trading session. A break above 1.1325 might open the way for a test of the June 23 highs at 1.1348.