- EURGBP trading 0.29% higher at 0.8904 as the rebound from 4-month lows continues. Pound traders will closely watch the speech by PM Boris Johnson

EURGBP trading 0.29% higher at 0.8904 as the rebound from 4-month lows continues. Pound traders will closely watch the speech by PM Boris Johnson as he will announce the final Brexit offer to EU. Bank of England’s Saunders said that there is a possibility of an interest rate cut even if a no-deal Brexit avoided. He also added that interest rates could go either way after Brexit, and the persistent uncertainty weighs on UK economy.

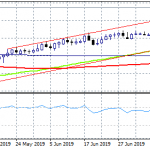

EURGBP Technical Analysis

EURGBP positive momentum is intact as the pair holds above the critical 200-day moving average. On the technical analysis side, the momentum is neutral for the short term. Bears are in control for the longer term as the pair trading below the 50 and 100-day moving averages. On the upside immediate resistance stands at 0.8914 today’s high, while a break above will open the way for a move up to 0.8968 the 100-day moving average. For those looking to buy the pair, an entry point can be when the pair breaks convincingly above the 0.8914 top.

On the downside, first support stands at 0.8876 today’s low, then at 0.8831 the 200-day moving average, while next support level is defined at 0.8723 the low from May 21st. Investors holding short positions can sit comfortably as long as the pair trades below 0.89.