- EURGBP trades in positive tone but faces the strong resistance at 0.8850. The pair tested the previous week the 200-day moving average and managed to

EURGBP trades in positive tone but faces the strong resistance at 0.8850. The pair tested the previous week the 200-day moving average and managed to rebound targeting now a break above the 50-day moving average. The British pound is under selling pressure this week as the concerns of a spiralling deficit and a looming debt crisis increase. The UK deficit will hit 273 billion in 2020, as the UK economy is shrinking at the fastest pace since WWII; the March GDP contracted by 5.8%, while the first quarter GDP contracted by 2% the largest fall since the financial crisis.

The Bank Of England (BOE) Governor Andrew Bailey has rejected the negative interest rates and said that the central bank could help the UK overcome the extra debt piled during the COVID-19 outbreak. Bailey also noted the BOE’s policies could avoid the need for austerity in the next months.

BoE said that the COVID-19 crisis has eclipsed Brexit as a source of concern about the economic health of the UK, and expects coronavirus to have a significant and lasting impact on the economy and society.

Meanwhile, in Eurozone, the clash between the ECB and the German Constitutional court continues with many analysts now expecting that EU infringement proceedings against Berlin might trigger a significant escalation that would be very difficult to resolve.

Download our Q2 Market Global Market Outlook

EURGBP Price Technical Levels To Watch

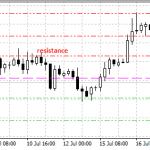

EURGBP is 0.13% higher at 0.8851, at six-week highs but now faces the critical 50-day moving average resistance. The technical picture is positive for EURGBP, while a close above 0.8850 might initiate another leg higher targeting the 0.89 mark. What can cancel the bullish momentum is a break below the 100-day moving average at 0.8664.

On the upside, immediate resistance stands at 0.8870 the daily high. A break above might challenge the next resistance at 0.8905 the high from April 1. If the EURGBP pair break above 0.8905 then might test the next supply zone at 0.8965 the high from March 27.

On the other side, the first support for EURGBP stands at 0.8831 the daily low. A close below 0.8831 might test the next support zone at 0.8714 the 200-day moving average. More bids for the EURGBP might emerge at 0.8664 the 100-day SMA.