- In this EUR/USD signal, we explain why the pair could soon drop to 1.1850 and then rally to 1.1950 as traders eye the bond market

The EUR/USD price is under pressure as the US bond yields bounce back and after the relatively mixed German trade data. It is trading at 1.1885, which is slightly below the year-to-date high of 1.1928. It is still 1.5% above the lowest level in March this year.

What happened: The EUR/USD price has been relatively sensitive to the price action in the bond market lately. Today, the bond yields have risen even after Jerome Powell insisted that the Fed will not hike rates or change its policy as the economy rebounds. The yield of the 10-year government bond has risen to 1.66% while the 30-year bond yield has risen to 2.3%

Why it matters: Rising yields are usually signs that investors are optimistic about the economy. As a result, it sends a message that the market expects the Fed to hike interest rates. Higher rates, on the other hand, usually lead to a stronger US dollar.

The EUR/USD is also falling because of the weak German exports data. In February, the country’s exports rose by 0.9%, a decline from the previous increase of 1.6%. In the same period, imports bounced back by 3.6%.

What next for EUR/USD?

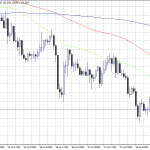

The four-hour chart reveals that the EUR/USD rose to above the 61.8% Fibonacci retracement level at 1.1928. However, the momentum has faded, pushing the pair below this retracement at 1.1907. It is attempting to move below the 25-day and 15-day moving average and is above the dots of the Parabolic SAR. Therefore, the pair may keep falling as bears target the next key support at 1.1850 and then resume the upward rally to the 50% retracement at 1.1970.