- In this EUR/USD forecast, we look at what to expect today as the Georgia results come in.

The EUR/USD pair is little changed today as traders watch out for the incoming results of the Georgia Senate race. The EURUSD price is trading at 1.2293, which is slightly below yesterday’s high of 1.2325.

What happened: Georgia residents went to the polls yesterday to elect their Senate representatives. Republican David Perdue was competing against Jon Ossof while Kelly Loeffler was competing against Richard Warnock.

The results of these elections are streaming in and there is a possibility that the two Democrat candidates will win the Senate. As of 05:00 GMT, the race was in a virtual tie, with Warnock leading Loeffler.

The EUR/USD pair will possibly rise if the two Democrats win because it will lead to more stimulus. It will also remove gridlock in Washington.

However, if Republicans wins at least one of the seats, the EURUSD pair will likely drop since it will lead to gridlock in Washington. Senator Mitch McConnell will be able to block most of Biden’s agenda. What else: The Georgia election will be the key mover of the EUR/USD pair today. Other key numbers to watch will be the important services PMIs that will be released by Markit. In Europe, economists expect the services PMI to remain unchanged at 47.3 while in the US, they expect it to drop to 55.3. Also, the pair will react mildly to the ADP private payroll data.

EUR/USD technical outlook

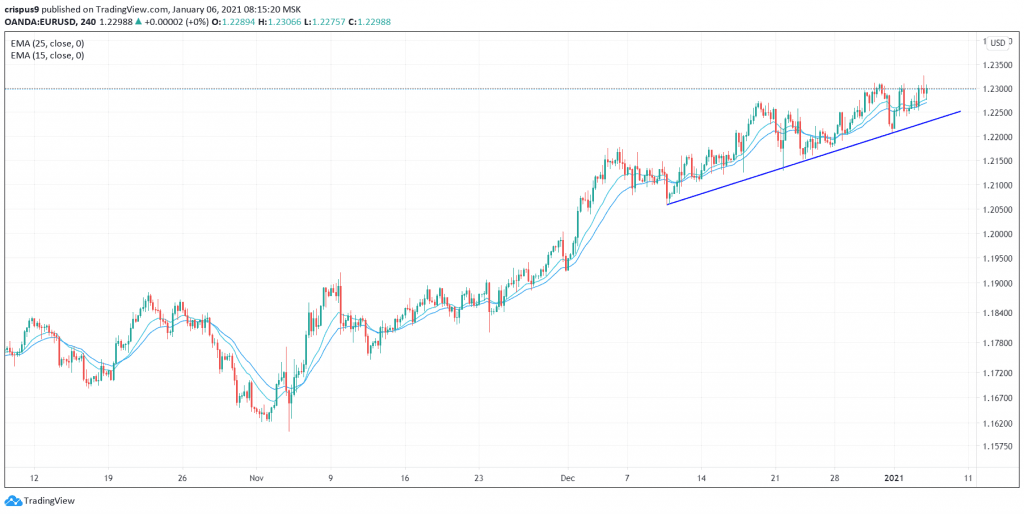

The EUR/USD pair is in a sharp upward trend as shown in the four-hour chart below. It is above the ascending blue trendline and the 25-day and 15-day moving averages. Therefore, the pair will possibly continue rising as bulls aim for the next resistance level at 1.2350. However, depending on the final results, things could change, pushing the EURUSD at 1.2250.

EUR/USD technical chart