- In this EUR/USD forecast, we look at what we should expect the pair to perform ahead of the ECB interest rate decision later this week

The EUR/USD pair is down for the fourth consecutive day as the sell-off on the euro accelerates. The EURUSD is trading at 1.2075, which is 2.18% below this year’s high of 1.2353. This week, the biggest mover will be the European Central Bank (ECB) interest rate decision. The EUR/GBP is trading at the lowest level since November 23 while the EUR/AUD is at the 2019 lows.

What’s happening: After having a major rally, the EUR/USD started a new bearish trend last week. This is after the pair started forming a bearish divergence, as my colleague identified a week before.

The performance of the pair is because of the overall strength of the dollar ahead of the Joe Biden inauguration. Last week, he unveiled a $1.9 trillion stimulus package that will possibly lead to a faster recovery and higher rates.

This week, the biggest events will be the inauguration and the ECB decision on Thursday. The bank will most likely leave interest rates and quantitative easing policies unchanged. With the euro weakening, Lagarde will possibly not hint of any policy changes in the near term.

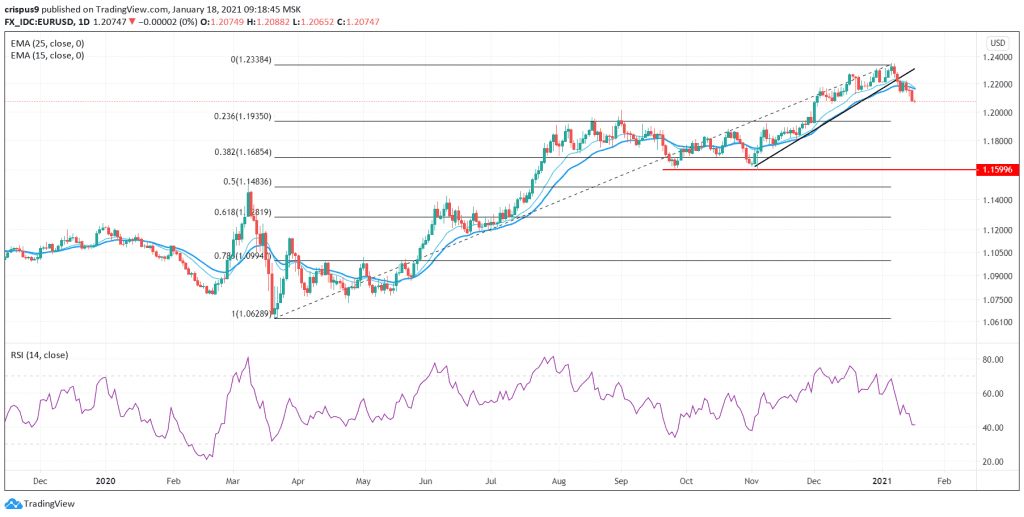

EUR/USD technical outlook

On the daily chart, we see that the EUR/USD has moved below the 25-day and 15-day exponential moving averages. The two have also made a bearish crossover pattern. Also, it has moved below the ascending trendline. Notably, it is approaching the 23.6% Fibonacci retracement level at 1.1935. Therefore, with bears being in control, the pair will possibly test that support ahead of the ECB decision.