- The EUR/USD is up for a 4th straight day, but could experience some headwinds as a key resistance level comes into view.

The EUR/USD has extended the gains made post-ECB as the greenback slips on the back of a combination of factors. Apart from a reversal in yields, a short squeeze of the greenback in the USD/JPY pair is also playing out in the EUR/USD and other USD pairs. In addition, traders long on the US Dollar are also taking some profits, enabling the single currency to extend gains by 0.33% on the day.

This move puts the EUR/USD on the path of a 4-day winning streak, as it also rides the wave of the recent larger-than-expected interest rate hike by the European Central Bank (ECB). However, the pair remains under pressure from geopolitical factors after Russian gas company Gazprom cut its energy exports to the Eurozone last week. The ECB says that energy price increases will lead to a cut in the Eurozone output by 0.8%.

Additional fundamental triggers for the week come mainly from the US side of the equation. The ISM Manufacturing and Services PMI data are due for release on Monday and Wednesday, respectively, while the US Non-Farm Payrolls report comes up on Friday, 5 August.

EUR/USD Forecast

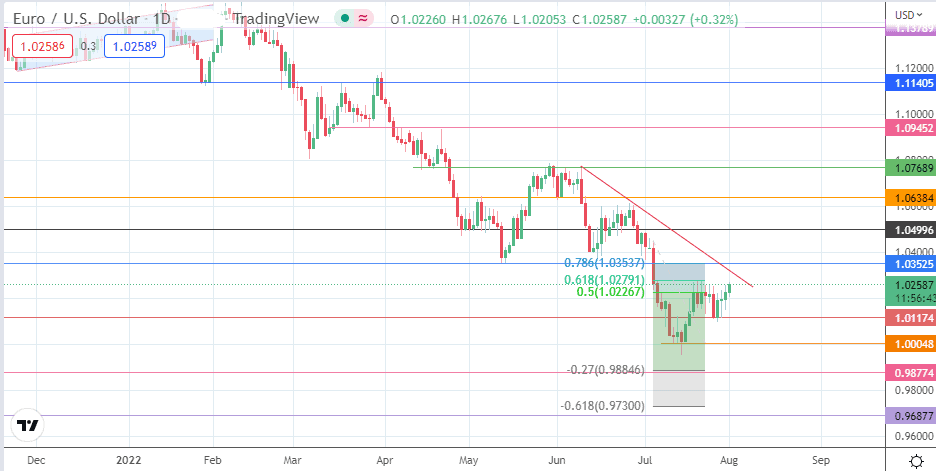

The bearish market structure remains intact, with the EUR/USD showing an upward retracement from the recent downtrend move. The price is now approaching the 61.8% Fibonacci retracement level at 1.02791, previously tested on 19-21 July without a successful break. However, the bulls need to get some momentum from the progressively high lows to break this resistance, targeting the 78.6% Fibonacci retracement at 1.03537 (12 May 2022 low).

A break of the trendline and this resistance level interferes with the structure, creating a pathway to the 1.04996 price resistance (15 June 2022 high). Additional bull harvest points come in at 1.06384 (5 May high, 2 June low) and 1.07689 (9 June high).

On the flip side, the bears would seek rejection at 1.02971 or the 1.03537 price barriers. If this plays out, the downtrend structure is retained, and the bears can target 1.01174 initially. A breakdown of this pivot opens the door toward recent lows at parity before additional harvest points come in at 0.98774 (27.0% Fibonacci extension) and potentially at 0.96877, where the 23-year lows are found.

EUR/USD: Daily Chart