- The EUR/GBP pair drifted sideways as investors waited for the ECB interest rate decision. They ignored weak German unemployment rate data and Spanish GDP

- The EUR/GBP pair was little changed as traders waited for the ECB interest rate decision.

- The pair ignored some tragic numbers from Europe, including the German unemployment rate.

- Other bad news were the Spanish GDP data and French consumer spending numbers.

The EUR/GBP pair was little changed as the market waited for important eurozone CPI data and the ECB interest rate decision.

EUR/GBP waits for ECB interest rate decision

The biggest news today will be the ECB rate decision, which will come at 11:45 GMT. This will be an important decision because investors are eager to hear from the ECB. This decision will come a day after the Fed left interest rates unchanged.

The ECB will likely leave the deposit facility rate at minus 0.50% where it has been for a number of months. It will also leave the marginal lending facility and interest rate unchanged. Any tweaks could lead to significant moves of the EUR/GBP pair.

Still, there are several things the bank could do to spur growth in the region. First, the bank could follow the Fed and BOJ steps and remove the cap of its bond purchases. In the most recent decision, this cap was increased to 750 billion euro and latest data show that 100 billion of this has already been spent. Therefore, the bank could announce that it will either remove the cap or increase the amount. Still, the ECB could just signal that it is ready to do more if needed.

Second, as I reported last week, the ECB had tweaked its policy and started issuing collateral for the so-called fallen angels. These are heavily leveraged companies that will likely be downgraded as the region deteriorates. This was a risky manoeuvre but the bank could do more today. It can follow in the footsteps of the BOJ and Fed and start buying these risky bonds.

The EUR/GBP pair could also move if the ECB decides to adjust the Targeted Longer Term Refinancing Operations (TLTRO). This is a program that provides banks with money to lend to customers. The ECB charges a -0.75% rate for these funds. In today’s meeting, the bank can tweak this provision and even increase it to minus 1%. Also, the bank can do the unthinkable and buy debt from European banks.

EUR/GBP ignores weak economic data from Europe

The EUR/GBP pair has stayed numb to the weak data that we have received today. In Germany, the unemployment rate dropped to minus 2.8% from the previous gain of 6.5%. This is mostly because many people in Germany were staying at home. In France, consumer spending nosedived in March when it declined by 17.9%. This was a significant decline from the previous decline of 0.5%.

The EURGBP was also little changed when Spain released its GDP data. The economy contracted by an annualised rate of 4.1%. Worse, it declined by 5.2% in the first quarter and the second quarter will likely be worse.

We also received some tragic numbers from Germany, where the unemployment rate rose from 5.0% to 5.8% in April. In the next hour, we will also likely receive weak inflation numbers from the eurozone.

Download our Q2 Market Global Market Outlook

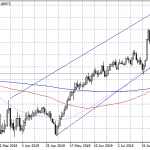

EURGBP technical outlook

On the four-hour chart, we see that the EUR/GBP pair has been moving in a sideways direction this month. The price has now found some support along the 61.8% Fibonacci retracement level. This price is a few pips below the 100-day EMA and is along the 50% EMA. At the same time, the volatility is at the lowest level since February 28.

Therefore, this could be a calm from the storm. The question is whether the ECB interest rate decision will be the storm. At this point, it is wise to remain in the side lines as you wait for a breakout. As you do this, the key points to focus on are the support and resistance levels at 0.8676 and 0.8863 respectively.