- The EUR/GBP is expected to decline further on the basis of divergent fundamentals in terms of exposure to the energy crisis.

The EUR/GBP pair is down marginally this Tuesday, sending the pair lower for the third straight session. In a week with limited fundamental catalysts on both sides, it has been a playbook of which of the two economies has a poorer outlook heading into the winter.

The Euro is seen as having weaker fundamentals as it is more exposed to the impact of a worsening energy crisis as the Russia-Ukraine war continues to drag. Russia has begun to cut off energy supplies to certain parts of Europe, which could make for a very dark winter within the Eurozone and push energy prices to highs not seen in decades. In contrast, the relative independence of the UK from Russian energy gives the Pound some insulation, even though the Bank of England and a few investment banks have a pessimistic outlook on the UK economy.

Despite rising EU inflation, the European Central Bank (ECB) has lagged behind the BoE regarding rate hikes. Eurozone data in July were dismal overall. With the Eurozone economic outlook also deteriorating within this time frame, the ECB may have run out of time to deliver another to control EU inflation without sparking a full-blown recession.

The outlook is for a further weakening of the EUR/GBP, based primarily on the potential for a severe energy crisis in winter unless a deal is reached to end the war and normalize the situation.

EUR/GBP Forecast

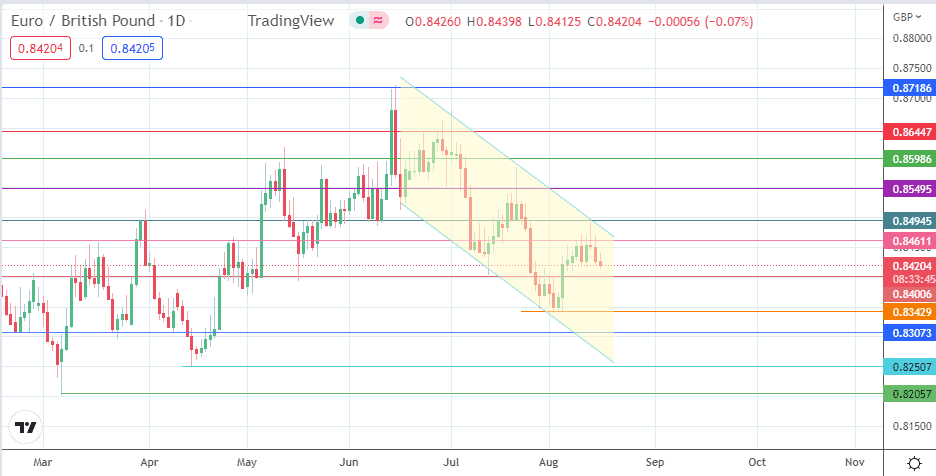

The decline in the pair comes after the pinbar candle formed off the rejection at the channel’s upper border and the 0.84945 resistance. Monday’s candle reflected an initial return move following Friday’s closing penetration below the 0.84611 support (26 April high and 18 July low). However, the rejection cemented the role reversal of that price level and has opened the door for the 0.84006 to become a downside target for the bears.

A breakdown of this pivot (17 May/13 July lows) opens the door for the bears to aim for 0.83429 (2-4 August lows) before reaching 0.83073 (22 March and 8 April lows). Further price deterioration brings 0.82507 (14 April low) into the mix before the 0.82057 pivot (7 March low) becomes a viable harvest point.

Conversely, the bulls need to breach the channel’s upper boundary at the 0.84611 price mark and the 0.84945 resistance to make room for an advance toward 0.85945 (2 June and 7 July highs). The 0.85986 (6 July high) and 0.86447 (28 June high) price barriers form additional northbound targets. Only when these targets are cleared can the bulls aim for two-month highs at 0.87186.

EUR/GBP: Daily Chart