- This article presents the Ethereum price prediction for 2025, 2027, and 2030, and shows what HODLers are to expect going forward.

Vitalik Buterin conceptualized Ethereum in 2013 and published a whitepaper to this effect in which he described a decentralized, censorship-resistant network to develop applications with real-life use cases. However, Ethereum was born in June 2014 when eight co-founders met in the woods to establish the foundation of what was to become the 2nd largest blockchain network.

Ethereum price has been in an intense downtrend since mid-December 2025 and has lost 45% year-to-date. That performance makes it the worst performer among the top ten cryptocurrencies. The resulting sentiment has seen in fall down the preference ladder among altcoins. It dropped to two year lows of $1,385 in early April, but has since risen to trade at $1,820 as of this writing; a 31% gain in the last three weeks. Nonetheless it is still 62% below all-time highs of $4,878 recorded in November 2021.

| Ethereum price now | $[crypto name=”ethereum” type=”price”] |

| Ethereum’s Price change percentage 24h ago | [crypto name=”ethereum” type=”priceChangePercentage24h”]% |

| Ethereum’s Price change percentage 7 days ago | [crypto name=”ethereum” type=”priceChangePercentage7d”]% |

| Ethereum’s highest price 7 days ago | [crypto name=”ethereum” type=”high7d”]$ |

| Ethereum’s lowest price 7 days ago | [crypto name=”ethereum” type=”low7d”]$ |

| Ethereum’s highest price 90 days ago | [crypto name=”ethereum” type=”low90d”]$ |

| Ethereum’s lowest price 90 days ago | [crypto name=”ethereum” type=”low90d”]$ |

| Ethereum’s highest price all time | [crypto name=”ethereum” type=”highAllTime”]$ |

| Ethereum’s lowest price all time | [crypto name=”ethereum” type=”lowAllTime”]$ |

| Ethereum’s lowest price change percentage of all time | [crypto name=”ethereum” type=”lowAllTimeChangePercentage”] |

| Ethereum’s lowest price change percentage of all time | [crypto name=”ethereum” type=”highAllTimeChangePercentage”] |

| Ethereum’s rank | [crypto name=”ethereum” type=”rank”] |

Coin Founders

Eight co-founders are behind the development of Ethereum. Vitalik Buterin, Gavin Wood, Anthony Di Iorio, Charles Hoskinson, Amir Chetrit, Jeffrey Wilcke, Mihai Alisie and Joseph Lubin are the eight original founders of Ethereum. Of the eight co-founders, Vitalik Buterin remains the only one still actively involved in work on the platform and has become the public face of the project. At least two of the eight co-founders left to start their blockchain projects. The others are involved in other projects supporting Ethereum or have left the industry entirely.

Ethereum Road map

The development of Ethereum was funded by a crowd sale that took place between July and August 2014. More than $18m was raised, with the first live release of the Ethereum blockchain occurring in 2015. Here is a brief timeline of the Ethereum roadmap.

In May 2015, 25,000 ETH were distributed as rewards for stress tests conducted on the Public Testnet in what was known as the Olympic testing phase. This was followed closely in July 2015 by Frontier, which was the official launch of the public mainnet. The genesis block was mined into existence, with transactions being suspended for a few days to allow for more significant signups from miners and clients. At this time, 5 ETH was the block reward.

Homestead followed in March 2016. This upgrade introduced the Mist ETH wallet and new codes for the Solidity programming language. In addition, the Canary contracts were abolished. The DAO hard fork occurred in 2016 after the theft of $50m worth of Ethereum. The vulnerability led to the split and creation of Ethereum and Ethereum Classic.The Byzantium upgrade reduced the mining rewards from 5ETH to 3ETH. This upgrade occurred on 16 October 2017.

February 2019 brought the Constantinople upgrade, reducing block rewards from 3ETH to 2ETH. Smart contracts could now verify each other with a hash of another contract, and this upgrade also provided better support of off-chain transactions. October 2019 brought the Istanbul upgrade, the next hard fork, and upgrade that preceded Serenity.

Changes to gas costs for different operations were proposed, and the ProgPoW mining algorithm reduced the efficiency advantage of ASIC miners., known as Ethereum 1.x. The first phase of Serenity (Serenity Phase 0) signals the move from the proof-of-work to the proof-of-stake consensus mechanism.

Serenity Phase 1 launched in 2020, dividing the network’s transactions among several sets of randomly organized validators. The Beacon Chain now supports 1024 Shard chains with validation by collecting 128 nodes.

Ethereum Merge Upgrade

In September 2022, Ethereum activated the merge, which brought together the old version and the Beacon Chain. As a result, Ethereum moved from being a proof-of-work (PoW) network to a proof-of-stake network. This was a major milestone for the biggest layer 1 smart contract platform on the planet, which received widespread attention from the whole crypto community.

Ethereum Shapella/ Shanghai Upgrade

In April 2023, Ethereum underwent the Shanghai upgrade, which enabled the unstaking of the ETH crypto from the beacon chain. This was a major development for the whole ecosystem as the validators had billions of dollars of ETH locked. The update also reduced the gas fees for some transactions and implemented better security features with improved support for L2s.

Ethereum TVL & Adoption Stats

Ethereum is currently by far the biggest smart contract platform in terms of on-chain activity and the total locked value (TVL). Currently, the network boasts $26.4 billion TVL, which is 60% of the total TVL across all blockchains. Most of this TVL comes from decentralized applications (Dapps) like LIDO, AAVE, Maker DAO, and Uniswap.

What has been the story of Ethereum’s price adoption?

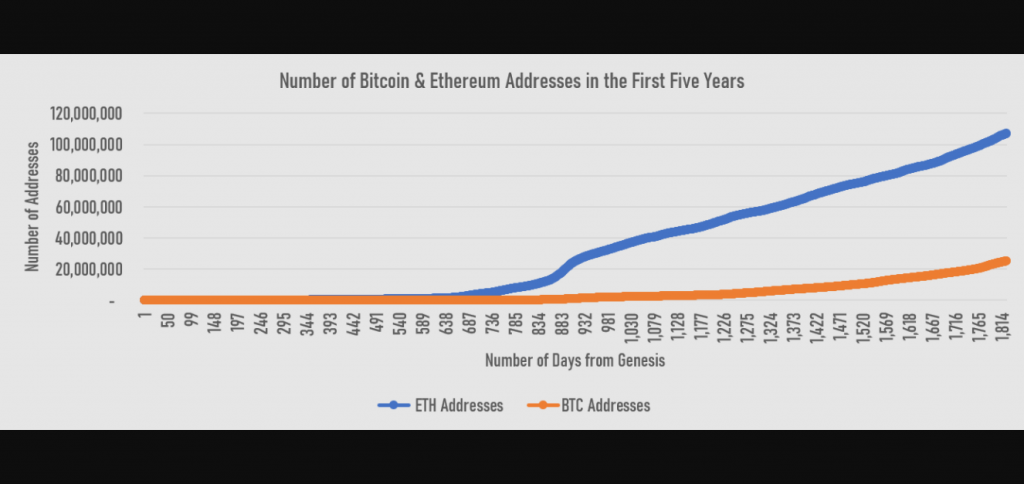

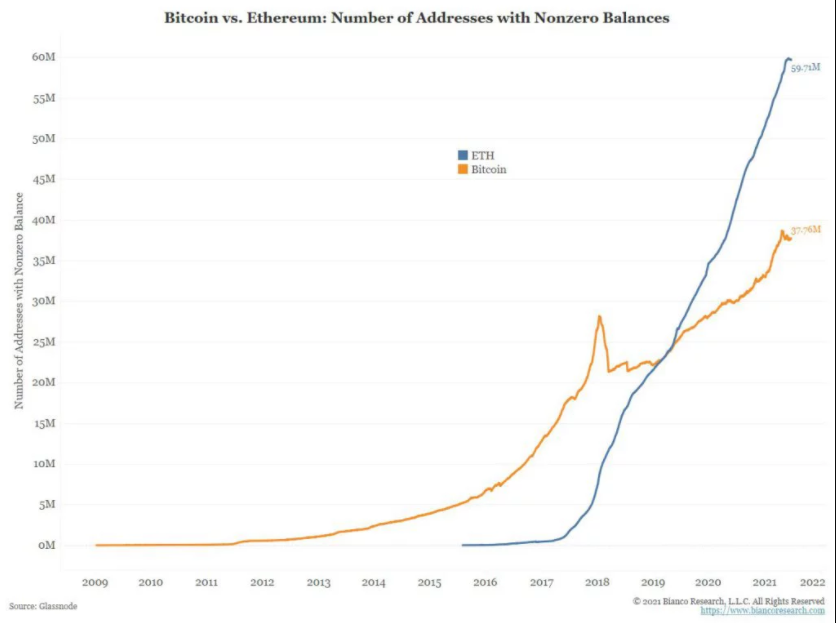

– The number of Ethereum addresses in the last five years has grown tremendously, far exceeding that of Bitcoin.

– Ethereum remains the platform of choice for many developers of decentralized applications (dApps). Nearly 80% of all dApps are built on Ethereum. The data from Consensys is shown below.

As of July 2021, Ethereum had over 689,000 addresses and exceeded the number of active BTC wallets by more than 200,000, in data showcased by Benzinga.By December 2021, non-zero Ethereum wallets hit an all-time high of 71,364,788. This was made possible by the explosion in interest in non-fungible tokens (NFTs). This data piece was pulled from Glassnode.

The various metrics measured show that Ethereum adoption and usage continue to grow, despite the price correction experienced recently.

[crypto name=”Ethereum”]

Ethereum Price Prediction 2025

Ethereum price formed a death cross in late February 2025 when the 50-day Moving Average (MA) crossed below the 200-day MA. The coin currently trades at $1,820, marginally above the 50-MA of $1,787, but will need to reclaim the $1,900 support to build traction for the upside. A stronger bullish momentum could come into play if the coin retests the current 100-day level of $2,206. That could clear the path to test the next barrier at $2,725, beyond which ETH price could hit the psychological $3,000 mark.

On the other hand, a major correction in ETH to $1,380 will be on the cards if BTC breaks down below $1,600. Furthermore, an extended bearishness could take the action lower to test $1,070

I’ll keep posting my updated ETH price prediction and my personal trade setups on Twitter, where you are welcome to follow me.

Ethereum Price Prediction 2027

The Ethereum price prediction 2027 on the weekly chart below shows that the coin broke out of a wedge pattern in early 2025. While that signals bearishness, ETH has recently signaled a reversals, and could recover its long-term uptrend if it reclaims the $2,000 psychological support. That could give it traction to retest the $2,510 barrier. Action above that level will raise the prospect of the coin breaching the $4,000 hurdle.

If ETH price manages to flip that mark into a support level, there’s a good chance it could rise to hit new record highs of $5,230 by 2027. On the downside, ETH price momentum will be subdued as long as it fails to breach the $2,510 pivot. The $1,550 mark is the most important support for medium-term momentum. A break below that level will signal a strong bearish hold that could send the coin lower to test $1,070.

ETH/USDT: Weekly Chart

Ethereum Price Prediction 2030

The Ethereum price prediction 2030 is that the coin could be trading closer to the $10,000 mark. This view is consequent on the ETH/USDT pair breaking above the $4877 mark (all-time high), which allows for a push to sequential Fibonacci extension targets at 7324, 8641, 9328, and 10316. But, again, this Ethereum price prediction 2030 depends on the ability of the bulls to hold the fort at the existing trendline that intersects the 50% Fibonacci extension level.

Is Ethereum a Good Investment?

Suppose there is any cryptocurrency that will remain relevant for years to come in terms of the sheer scale of its utility and application. In that case, Ethereum is a powerful candidate. Indeed, it will be a bold statement to say that the advent of Ethereum is the main reason the cryptocurrency market survived the teething challenges of its early years. The Mt.Gox saga nearly buried Bitcoin, but Ethereum resurrected it and led to the market revolutions that followed. The development of initial coin offerings (ICOs) and decentralized finance (DeFi), the development of smart contracts, and cross-chain interoperability are all products of Ethereum’s entrance into the blockchain arena.

How to buy Ethereum?

How to buy Ethereum is not an issue. It is available on almost every crypto exchange. There are two ways to do this. The Basic function allows for quick conversion of the purchase of fiat or cryptocurrency with Ethereum at market price. The Advanced process allows for expanded purchase options, such as setting limit prices, purchasing specific amounts, etc. Ethereum is usually listed in pairing with Bitcoin (ETH/BTC), US Dollar (ETH/USD), Tether (ETH/USDT) and several other cryptos.

Is ETH A Security?

“There are multiple fundamental and technical factors behind the negative ETH price action. According to the most recent news, the Securities and Exchange Commission of the United States had sued the top crypto exchanges Coinbase and Binance. These development are acting as the tailwinds for ETH.

SEC has labelled BNB, BUSD, MATIC, SOL, CHZ, ADA, and many other top cryptocurrencies as securities in its latest lawsuits. However, the regulator hasn’t taken any stance on Ethereum yet. Nevertheless, sooner or later we may have big news on the status of ETH as well.”

ETH/USDT: Monthly Chart