- All the bullish Ethereum price predictions seem to be hanging by a thread as the price dipped to $1700, last week.

The Ethereum price dipped to the lows of $1700 last week as the crypto markets faced an unprecedented sell-off. Most cryptocurrencies including Bitcoin have made fresh 52 week lows. The ongoing slump in traditional markets in general and tech stocks, in particular, has sent a ripple effect in crypto markets. While cryptocurrencies are eying a relief rally, many analysts believe that the worst is yet to come. Therefore, all the bullish Ethereum price predictions seem to be hanging by a thread.

At the time of writing, Ethereum price USD is $2040 which is 57% below its November 2021 ATH. This depreciation in price has quite adversely affected its ecosystem as well. Most Ethereum based tokens are trading at just a fraction of their 2021 all-time highs. Although ETH is up 24% from last week’s lows, still many investors are considering the current rally a dead cat bounce.

As per the Ethereum news today, the much-anticipated merge is expected to be rolled out by Q3/Q4 2022. This upgrade would initiate the transition of the Ethereum blockchain from proof-of-work consensus to proof-of-stake. This would be a major milestone in the development of Ethereum 2.0. Many holders are confident that this merge could trigger another bull run for the Ethereum ecosystem.

Ethereum Price Prediction

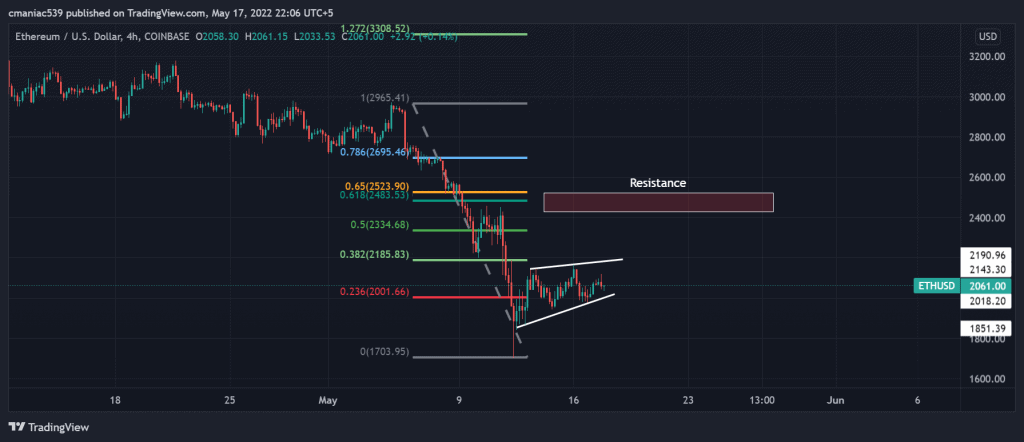

Technical analysis of the Ethereum price chart suggests that the price is forming a bear flag on the 4H chart. This bear flag could potentially plummet the price to as low as the $1400 level. However, there seems to be strong support around $1700-$1800 and another bounce from that level might give some hope to the bulls.

Any bullish Ethereum price prediction stands to be invalidated at this point due to the change in market structure. Any relief rally could be considered a dead cat bounce as long as the price stays below $2500. The next dip might present a decent buying opportunity before the upcoming merge with Ethereum 2.0. However, the past tells us that such historic milestones might also turn out to be ‘sell the news’ events. Therefore, any Ethereum investment before the recovery in Bitcoin prices is a high risk at this point.

ETH USD Price Technical Analysis