- The emergence of two bullish patterns appear to validate Ethereum price predictions for an advance towards $3650.

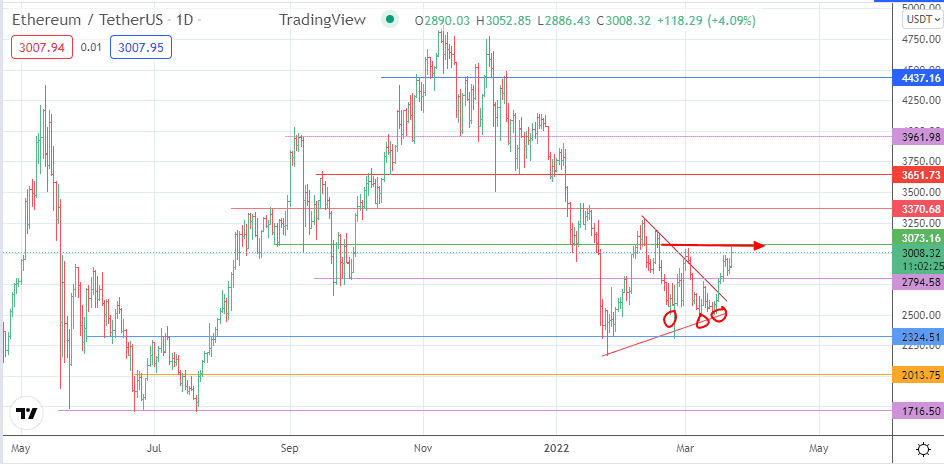

Bullish Ethereum price predictions have emerged as the ETH/USDT crossed the $3,000 price mark on Tuesday. The recent uptick follows a gradual push from the $2,500 price mark, where the pair found itself a week ago. This upside push has resulted in a break of the symmetrical triangle, with the potential for additional gains if the price activity breaks the 3073.16 resistance.

This resistance level is key. If the recent price activity is studied critically, this resistance is seen to be the neckline of the triple bottom pattern formed by the price dips of 22/24 February, 8 March, and 12-14 March. The evolving triple bottom will only be complete if the bulls break this neckline resistance, pointing towards the $3651.73 resistance as the target for the measured move.

On the fundamental front, more than 2 million Ether tokens have been burnt since the Ethereum Improvement Proposal (EIP) 1559 in August. This puts the project on course to the Merge upgrade, affecting the transition to the ETH 2.0 proof-of-stake consensus mechanism. Merge has been tested on the Kiln testnet but is not expected to come on stream until Q2 2022. Ethereum’s 3.98% uptick on the day has taken it slightly above the $3000 psychological resistance, where it continues to trade.

Ethereum Price Prediction

The breakout from the symmetrical triangle that was predicted last week has also broken the 2794.58 resistance barrier. The accompanying pullback towards the broken resistance-turned-support formed a small bullish flag, which has itself been completed by Tuesday’s upside move. The breakout from the triangle aims to achieve the measured move at 3651.73. The bulls must take out the resistance obstacles at 3073.16 (23 August 2021 and 15 January 2022 highs) and 3370.68 (7 October 2021 high/15 December 2021 low) to achieve the relevant price target.

Otherwise, rejection at the 3073.16 resistance could trigger a pullback that retests 2794.58. If the bulls fail to defend the latter, a drop towards 2500.00 (21 February/13 March 2022 lows) is inevitable. 2324.51 (22 January/24 February 2022 lows) is a potential pivot to the south that only becomes viable if the price declines below 2500.

ETH/USDT: Daily Chart

Follow Eno on Twitter.