- The Enjin Coin price prediction is based on the chart pattern and indicates a high potential for a further drop.

The ENJ/USDT pair is trading 0.63% higher ahead of the Jubilee weekend in the UK. Thursday’s price action has been marked by low trading volume, albeit tilting towards the bullish end of the spectrum. This follows the 9.16% slide experienced on Tuesday, as the crypto market gave way to selling pressure late in the day.

The news of the day is that the EFI rewards have been distributed to the parachain crowd loan process contributors. This news follows the advent of Enjin coins on the Coins.ph app. However, these events have had no impact on price action.

With no fundamental triggers of note, the Enjin Coin price predictions will be dictated by technical factors and by market sentiment. The sentiment on Thursday is only slightly bullish. Several cryptos are trading marginally higher, but only on the back of shallow volumes that are barely propping the pairs up on key support levels.

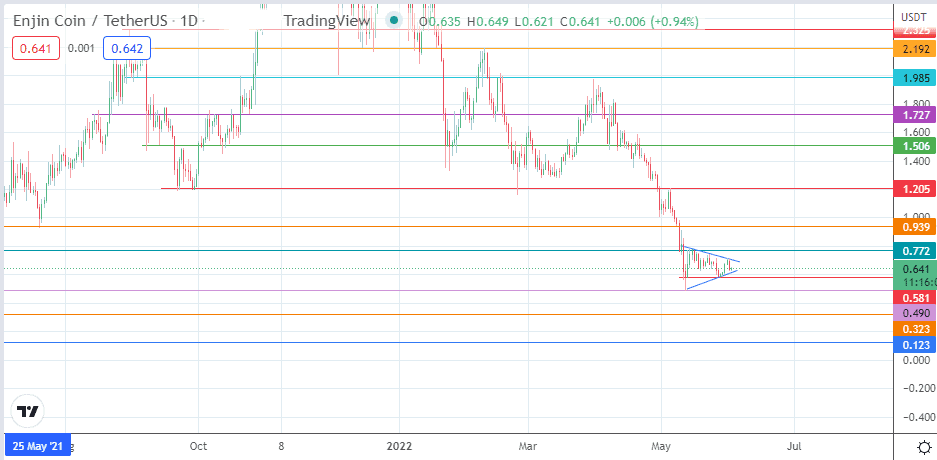

Technically speaking, the price action on the ENJ/USDT daily chart is trading within the range formed by the 0.772 resistance (ceiling) and the 0.581 support (floor). There is an emerging, non-descript triangle, with the active candle just bouncing off the triangle’s lower border. Check out how the price pattern will impact Enjin Coin price predictions.

Enjin Coin Price Prediction

A breakdown of the 0.581 support is required to send the ENJ/USDT pair to the 0.490 price support (2 January high and 12 May low). Below this price mark, additional support comes in at 0.323 (31 January low) and at 0.123, where the all-time low is located.

On the flip side, a break of the range’s ceiling at 0.772 (22 June 2021 low and 14 May 2022 high) allows the bulls to aim for the 0.939 resistance (20 July and 8 May low). Additional targets to the north are found at the 1.205 resistance (29 September 2021 low and 5 May 2022 high) and at 1.506 (20 March and 19 April highs).

ENJ/USDT: Daily Chart