- EasyJet share price has dropped by a percentage point, and marks the 10 consecutive session that prices are dropping.

EasyJet’s share price continues to struggle in the market as the company struggles to keep their airline running to the current staff shortage. As a result, today’s trading session is showing a drop of 1 per cent in EasyJet’s share price. Today’s trading session marks the 10th consecutive day that EasyJet’s share price has been dropping in the markets, which has resulted in a 21 per cent share price drop.

In June, EasyJet is expected to trim the number of scheduled flights to address the current chaos resulting in multiple flight cancellations. The axing of the flights has seen more than 10,000 travellers affected this week, and the number is likely to continue rising with more cancellations on the way.

The company has also had problems with delays, which has also seen many of their customers affected. However, the company has indicated its willingness to address the problem, and they have already announced they would be increasing their staff.

According to Transport Secretary Grant Shapps, the current EasyJet problems are a result of the understaffed aviation industry. After the COVID restrictions were lifted, the aviation industry failed to move fast enough to address the loss of staff during the pandemic period. Shapps admitted that with everything returning to normal, the number of workers has struggled to handle the huge logistics of people travelling, resulting in the current flight delays and cancellations.

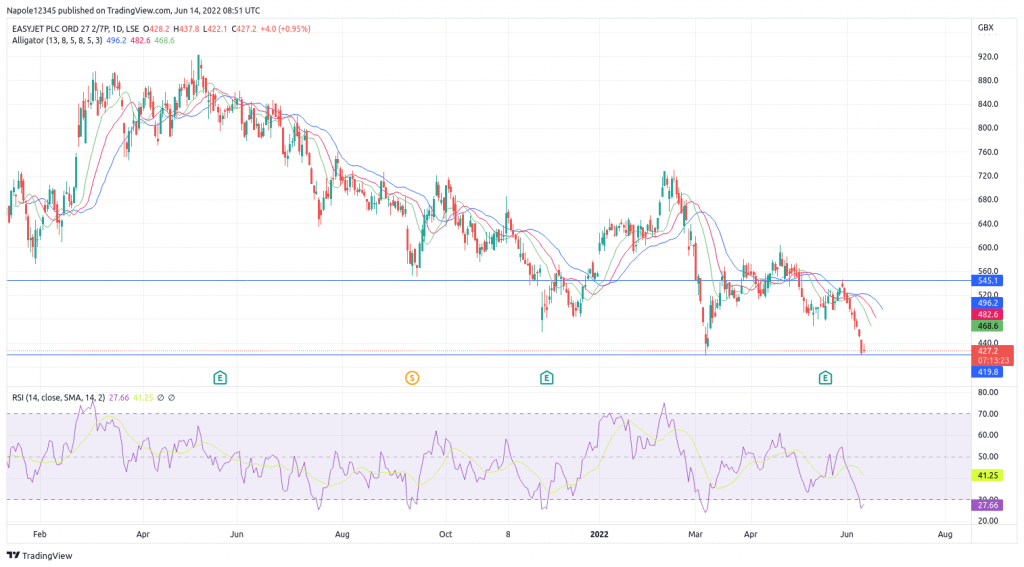

EasyJet Price Prediction

One of the reasons that are likely causing EasyJet’s share price to drop sharply is their handling of their clients in the past few weeks. For instance, over 10,000 EasyJet customers were left stranded on Monday as the company cancelled 64 flights. The company also indicated it would be cancelling about 40 flights a day to ensure no repeat of the half-term disruptions.

Such reports mostly do not translate well in the markets and with investors. Usually, the result is what we are currently seeing in the markets. Therefore, my EasyJet share price analysis expects the prices to continue falling as long as the company continues to run ineffectively.

As a result, there is a high likelihood that we will see the prices trading below the 400p price level. However, once they resolve their current issues, there is a high likelihood that we will start to see EasyJet’s share price recovery. As a result, my bearish analysis will also be invalidated.

EasyJet Daily Chart