The US dollar index (DXY) started the week with a bang. It is up by more than 0.40% and is trading at the highest level since December 23. It is also 1.50% higher than the lowest level this year.

What is happening: The dollar index is rising because of three main reasons. First, the nonfarm payroll numbers disappointed last week. As a result, traders are now pricing-in more stimulus once Joe Biden becomes president next week.

While this is a bearish thing for the dollar, it can be viewed positively. For one, more stimulus means that the economy will recover faster leading to high-interest rates coming earlier.

Second, the DXY is bouncing because of the rising number of coronavirus cases in China. The daily increase in Hebei has surged, pushing the country to order a lockdown that is affecting more than 11 million people.

Finally, the dollar is rising because of the political crisis in the United States, where Democrats will begin impeachment proceedings. This could lead to more tensions that are usually positive for the currency.

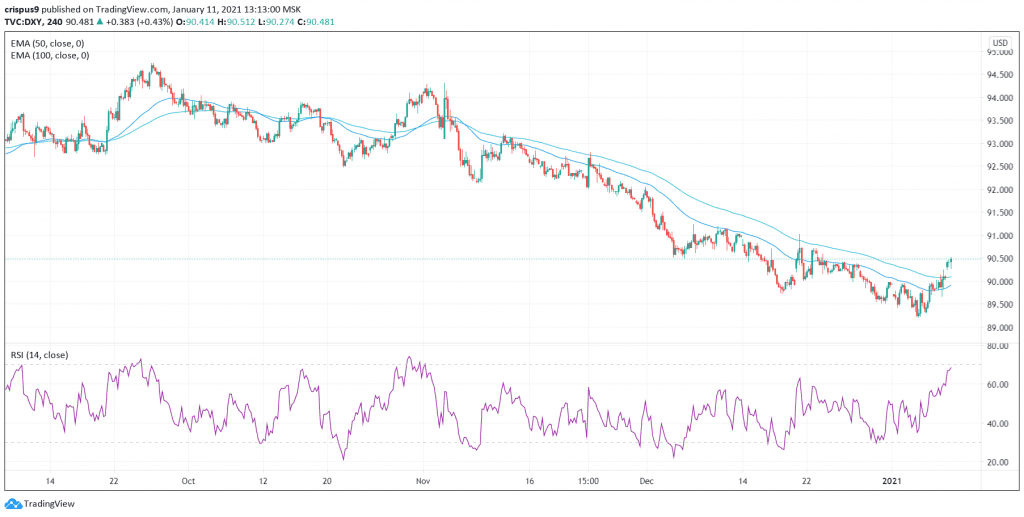

Dollar index technical outlook

On the four-hour chart, we see that the dollar index has bounced back in the past few days. It has also moved above the 50-period and 100-period exponential moving averages while the RSI has continued to rise. Therefore, in my view, the DXY will continue rising as bulls targets the next resistance at $91.00.