- The Dow Jones index is set to stage a recovery this Tuesday as investors plow into stocks beaten back by 3 days of selling.

This Tuesday, the Dow Jones index is set for recovery and has opened higher after a three-day stint in losing territory. Investors are seen buying into large-cap stocks and the financials after Wall Street sold off for three days straight due to the impact of the Fed’s 50bps rate hike and the Non-Farm Payrolls report. The Dow Jones index is up 0.98% as of writing. The Dow Jones index futures had been up 370 points at a point: the index is currently 324 points higher.

This Tuesday, the shares of Boeing, Intel, Walt Disney, and American Express are among the Dow’s top gainers. Conversely, Goldman Sachs, Visa, JP Morgan Chase, and Nike are among the losing stocks on the day.

The Dow’s phenomenal growth in the last two years was driven by the era of cheap money in a near-zero interest rate environment. However, the Fed raised interest rates with an aggressive 50bps move last Wednesday, causing a shift of investment flows away from stocks to the money market. Trading is still in the first hour, and the situation on the Dow remains fluid. Today’s earnings reports are those of ConocoPhillips, Sony Corp, 3M Co, Occidental Petroleum, and Suncro Energy Inc.

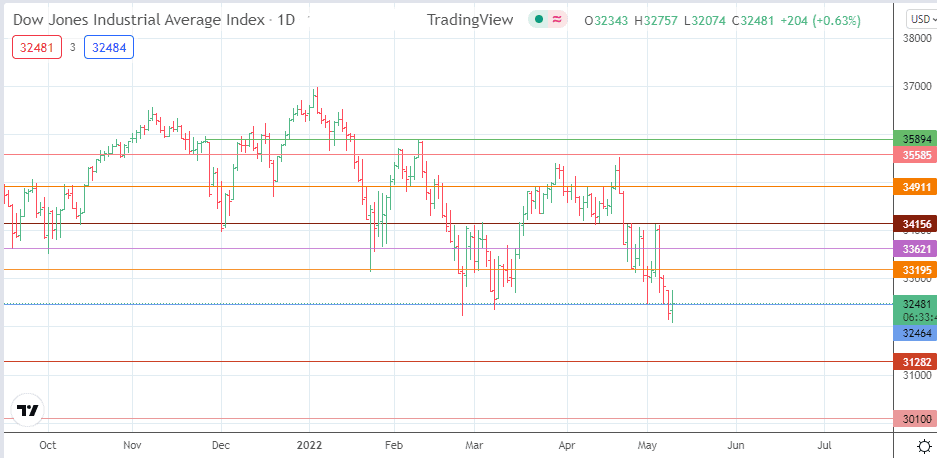

Dow Jones Index Outlook

The active daily candle is trading above the 32464 support level and needs to close above this support to preserve it. Failure to do so violates the support and opens the door for a move towards the 31282 pivots if the candle closes below 32464 (8 January and 10 January 2021 highs in role reversal) with a 3% penetration. Below this new support, the 30100 price mark constitutes a new pivot, being the site of a previous high on 9 November 2020 and an earlier low of 28 December 2020 and 7 January 2021.

On the flip side, an extension of the current uptick pushes the price activity towards the 33621 price mark (21 September 2021 low and 11 March 2022 high), with additional resistance seen at 34156 (3 March and 3 May highs). An advance above this level allows for a push towards 34911 (8/14 April highs), leaving 35585 and 35894 (9 February high) as additional targets to the north.

US30: Daily Chart

Follow Eno on Twitter.