- The Dow Jones Index is set to close lower for the 6th straight week as the Fed's rate tightening and jobs numbers weigh.

The trading activity on the Dow Jones index this Friday was all about the jobs numbers for April. The Department of Labor says that the US public sector (minus agriculture) added 428K jobs versus the 428K jobs added a month earlier. This was not only an improvement over the previous month’s number, but the latest figure also bettered the consensus number of 390K.

However, the unemployment rate stayed static at 3.6%, which was higher than the market projections of a 0.1% drop in this metric. The news means that the US has virtually recovered all the jobs lost to the pandemic, save for 1.2million of them.

Average wage growth cooled from 0.5% to 0.3% monthly, translating to a 0.1% drop on a year-on-year basis to 5.5%. This should ordinarily have been a source of some market optimism which is gradually facing erosion by tighter rates. However, the decline in the participation rate means there is still a labour supply shortage. The situation will warrant employers of labour to keep wages on an upward trajectory to keep skilled workers from jumping ship. This scenario will make a case for the Fed to continue on the path of aggressive rate hikes, a path that will ultimately be negative for the Dow Jones index.

The Dow Jones Index looks set to end the week lower for the 6th straight week, in response to the 50bps rate hike by the Fed and the jobs numbers, which could push the Fed to keep on tightening.

Dow Jones Index Forecast

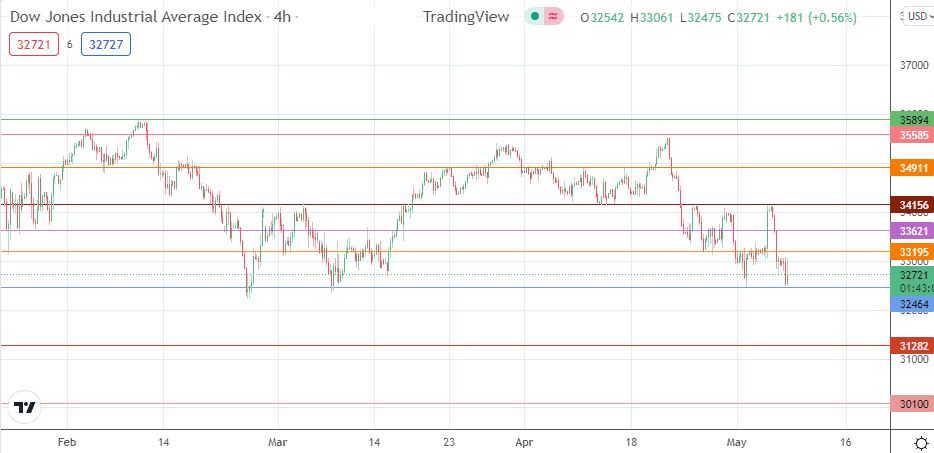

The index is off session lows after bouncing on the 32464 support (2 May low). This puts the 33195 resistance (27 April low and 4 May high) under pressure. If the bulls uncap this resistance, 33621 (27 April high) becomes the next upside target. 34156 (4 May 2022 high) and 34911 (14 April high) are additional harvest points for the bulls.

On the flip side, the bears need to degrade the 32464 support to open the door towards downside targets at 31282 initially, before 30100 comes into the picture as an additional target to the south.

Dow Jones: 4-Hour Chart

Follow Eno on Twitter.