- The US dollar index rose today as global stocks like the DAX index, Dow Jones, and the Nikkei 225 indices extended their losses in early trading today.

Global stocks are in the red today as investors react to the sharp sell-off of American stocks yesterday. In the US, the Dow Jones lost 807 points while the S&P 500 and Nasdaq 100 lost more than 125 and 600 points, respectively. That was the sharpest decline since March this year.

In Asia, the Nikkei 225 and Hang Seng declined by 260 and 394 points, respectively. In Australia, the ASX 200 lost more than 187 points. Similarly, in Europe, futures tied to the DAX index are down by 0.15% while those tied to the FTSE 100 and CAC 40 are down by 0.60% and 0.52%, respectively.

Other assets are also in the red. For example, crude oil price has dropped by more than 0.50% while silver is down by 0.10%. Cryptocurrencies like Bitcoin and Ethereum are attempting to crawl back as well.

The sharp correction that happened yesterday was mostly because of fears of the upcoming election in the US, the lack of stimulus in the US, and fears of valuation. On valuation, technology companies like Facebook, Apple, Microsoft, Amazon, and Google have seen their valuation climb to more than $8 trillion. That is a substantial number compared with the America’s GDP of more than $20 trillion. In other words, these companies are about 50% the size of the GDP. Apple alone has become valuable than all companies in the FTSE 100.

On the other hand, the US dollar index (DXY) has been in a strong upward trend this week. Indeed, it has risen by more than 1% in the past few days. This increase is mostly because of the rising possibility of a V-shaped recovery in the United States. Indeed, data from the US has shown that the economy is bouncing back. Later today, we will receive the nonfarm payroll numbers that are expected to show that the economy added more than 1.4 million jobs in August.

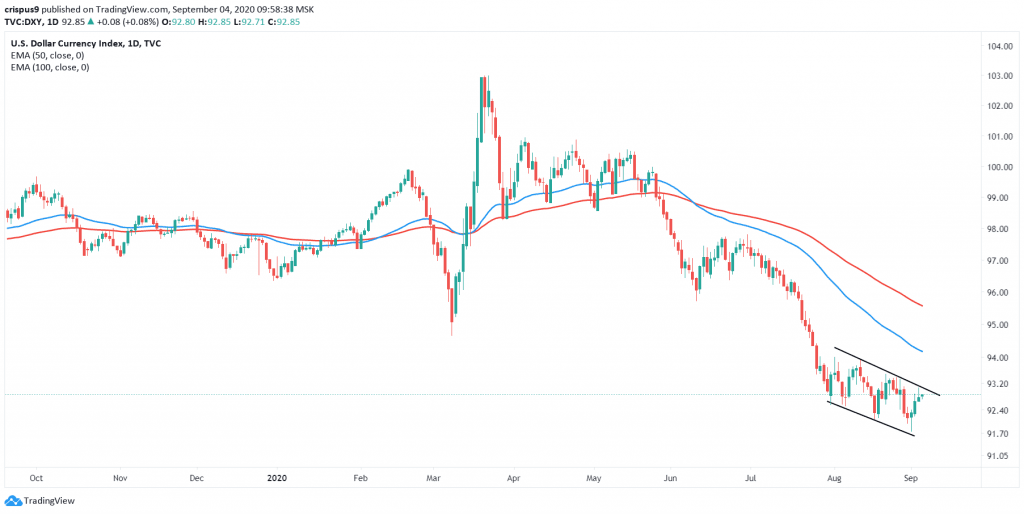

US dollar index technical forecast

The daily chart shows that the dollar index has been in an upward trend in the past few days. It is trading at $92.82, which is substantially higher than the intraday low of $91.75. This price is still below the 50-day and 100-day exponential moving averages. It is also along the upper side of the descending channel that is shown in black.

Therefore, there is a possibility that the index will turn lower today as bears attempt to test the lower side of the channel at $91.75. On the flip side, a move above this resistance could boost the possibility that the index will move high to test the resistance level at $94.