- The Tullow share price has been dragged down by the 3-day decline in crude oil prices despite merger with Capricorn Energy.

The Tullow share price is trading lower this Monday, following a fall in crude oil prices. This decline comes despite Moody’s Tullow stock upgrade following Tullow Oil’s merger agreement with Capricorn Energy. Last week, Tullow Oil announced it had agreed to an all-share merger with Capricorn Energy via a court-sanctioned scheme of arrangement.

This merger is worth $827 million and will allow each Capricorn investor to get 3.8068 Tullow shares for every Capricorn share held. The new group is expected to have an annual dividend of $60m, with a combined daily output of 100,000 barrels of crude, with reserves of 343 million barrels of oil equivalent.

Tullow CEO Rahul Dhir will remain as boss of the combined group. He has indicated that the capital combination from both companies would “have acceleration in it”, highlighting the merger’s synergistic effect in a conference call. However, the Tullow share price is down 1.45%, following the 3-day decline in crude oil prices. Brent crude is down nearly 2% in early London trading.

Tullow Share Price Forecast

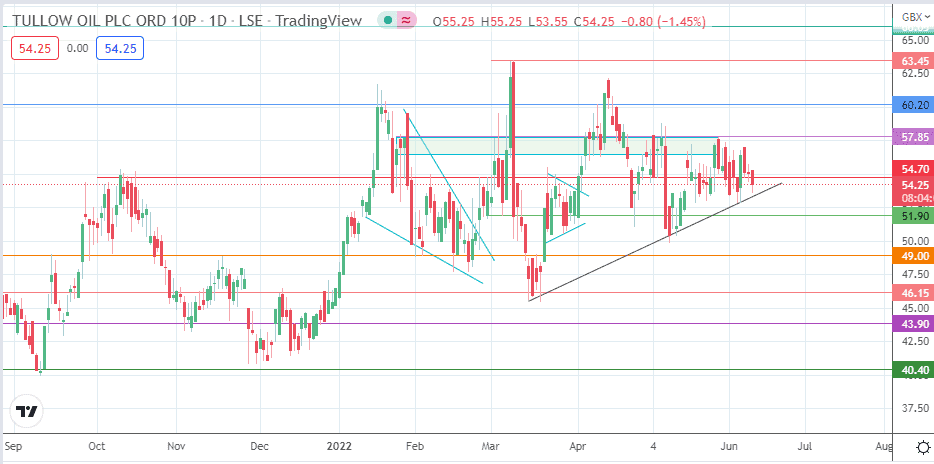

The support violation at 54.70 has met an obstacle at the trendline that connects the lows of 15 March, 12 May and 7 June 2022. A breakdown of this trendline is required for the bears to pursue an initial harvest point at the 51.90 price level (4 March and 1 April 2022 lows).

A further price deterioration sends the stock towards the 49.00 psychological support and site of previous lows of 6 January and 3 February. Additional support targets are seen at 46.15 and 43.90 (8 November and 24 December 2022 lows).

On the flip side, a bounce off the trendline which pushes the candle back above the 54.70 support, saves that pivot. The bulls would then need to initiate a strong push to the upside, targeting 57.85 initially (4 May/27 May highs). If the price action breaks this barrier, 60.20 becomes the next logical target (8 April high). Finally, the 8 March high at 63.45 comes into the picture if 60.20 gives way.

Tullow: Daily Chart