- The Diageo share price has been in a strong bearish trend in the past few weeks. The DGE stock is trading at 3,670p

The Diageo share price has been in a strong bearish trend in the past few weeks. The DGE stock is trading at 3,670p, which is about 10% below the highest level this year. This means that the stock has sunk into a correction zone ahead of its earnings.

Diageo is a leading alcoholic beverage manufacturer that is known for its brands like Guinness, Tusker, Johnie Walker, Ciroc, Captain Morgan, and Smirnoff among others.

The Diageo share price has done relatively well in the past few months. The stock has jumped by over 85% from its lowest level in April 2020. This jump has happened as the demand for alcoholic beverages has risen around the world even during lockdowns.

The next key catalyst for the Diageo stock price will be the company’s earnings scheduled for Thursday this week. Analysts expect that the company did well in the fourth quarter during the holiday season.

For example, analysts expect that the company’s pre-tax earnings rose to over 2.4 billion pounds in the first half of the year. They expect that its sales rose by about 11% to about 7.7 billion pounds in the same period.

Still, the biggest concern for the company will be its costs. With wages and commodity prices surging, there is a likelihood that the company’s earnings and guidance will be under pressure.

Diageo share price forecast

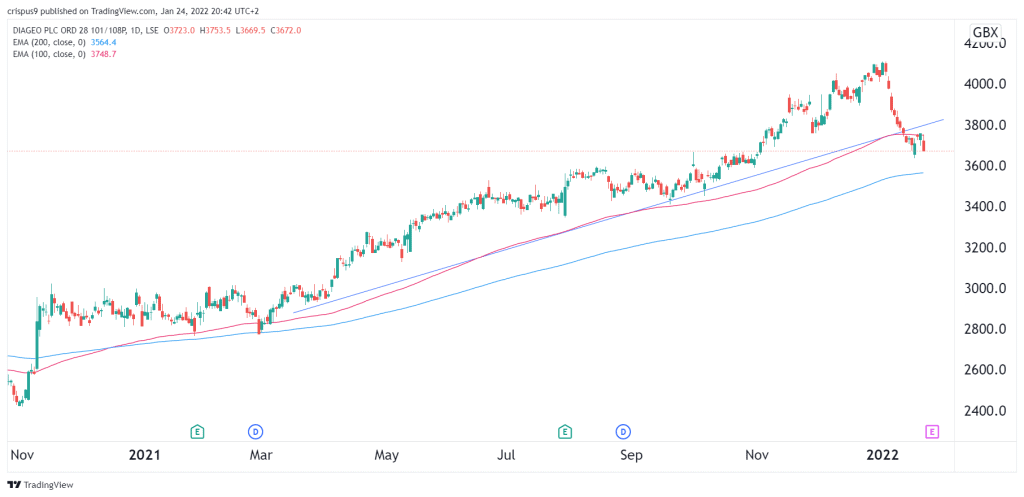

The daily chart shows that the Diageo share price has been in a strong bearish trend in the past few days. The stock has managed to drop below the key support at the 100-day exponential moving average (EMA). It is also hovering slightly above the 200-day EMA. It has also moved slightly below the ascending trendline shown in blue.

Therefore, the DGE share price will likely continue falling as bears target the key support at 3,600p, which is along the 200-day moving average. On the flip side, a move above 3,800p will invalidate the bearish view.