The DAX index has soared to an all-time high even as risks to the German economy remain. The index of the blue-chip German stocks has jumped by more than 22% this year. This makes it one of the best performers in Europe although it has lagged the S&P 500 and Dow Jones indices.

Risks to German recovery

The DAX index has risen in the past three straight days as risks to the German economy remain. There are several key risks. First, in a statement on Wednesday, Angela Merkel warned that the country was seeing a major wave of Covid-19. While the country has delivered millions of vaccinations, the rising cases pose major risks to the economy.

Second, the country seems to be losing its edge in the automobile industry. For one, countries that had a relatively smaller auto sector a few years ago have become leaders as the world transitions to electric cars.

For example, US has churned several large automakers. Rivian is currently bigger than companies like BMW. The same is true with companies like Tesla and Lucid Motors. In China, the country’s companies like Li Auto, XPeng, and Nio have seen strong performance. This means that German auto companies will likely struggle in the future.

Third, there are energy risks. With gas prices rising, there are concerns that Germany will be affected. Besides, a regulator has delayed the certification process of the Nord Stream 2 pipeline.

The best performing DAX index companies this year are Sartorius, Merck, Daimler, Siemens, Porsche, and Hello Fresh. These stocks have all risen by more than 50% this year. On the other hand, the worst performers are Siemens, Henkel, MTU Aero and Zalando.

DAX index forecast

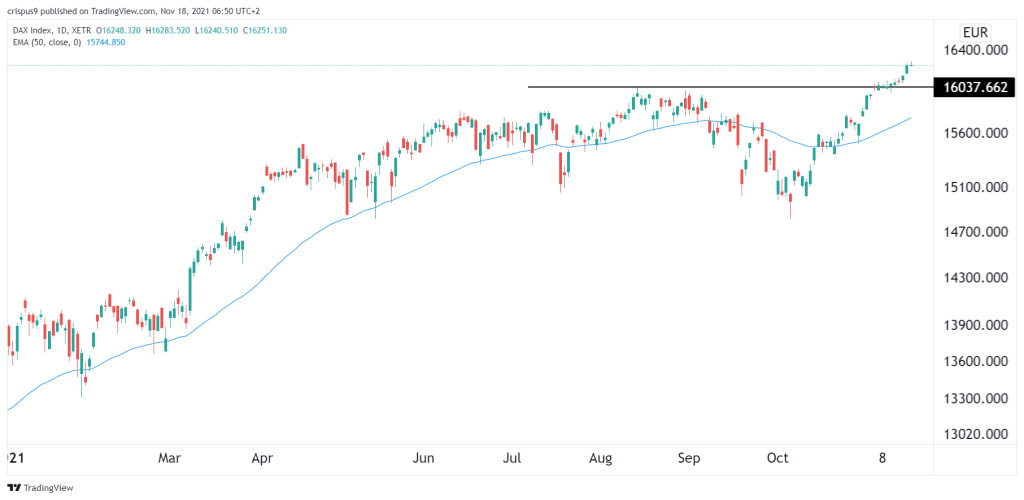

The daily chart shows that the DAX index has been in a major bullish trend in the past few months. The index has already moved above the key resistance level at €16,000, which was the previous year-to-date high. It is also being supported by the 25-day and 50-day moving averages.

Therefore, while the index has the momentum, there is a likelihood that it will have a break and retest pattern. This is where it moves and retests the previous key support and then resumes the upward trend. This support is currently about 1.5% below the current level.