- In this DAX index forecast, we look at why the German index will continue rallying in the near term despite the current setback

The DAX index is being pressured today ahead of key earnings from Europe and the United States. The blue-chip German index is trading at €13,776, which is lower than last week’s high of €14,157.

What’s happening: German stocks are falling as investors watch out for the next Chancellor of Germany. With Angela Merkel’s term about to end, her Christian Democratic Party has settled in Armin Laschet to become the next leader. However, a recent poll found that Armin has little support in Germany, with most people preferring Markus Soder of Bavaria.

The DAX index is also wavering ahead of key earnings data set for this week. While few major German companies are set to publish their earnings, the index will react to large American companies. Among those to watch will be Goldman Sachs, Bank of America, Netflix, and IBM. There will also be important European earnings, including Richemont, Rio Tinto, and Imperial Brands.

DAX index technical outlook

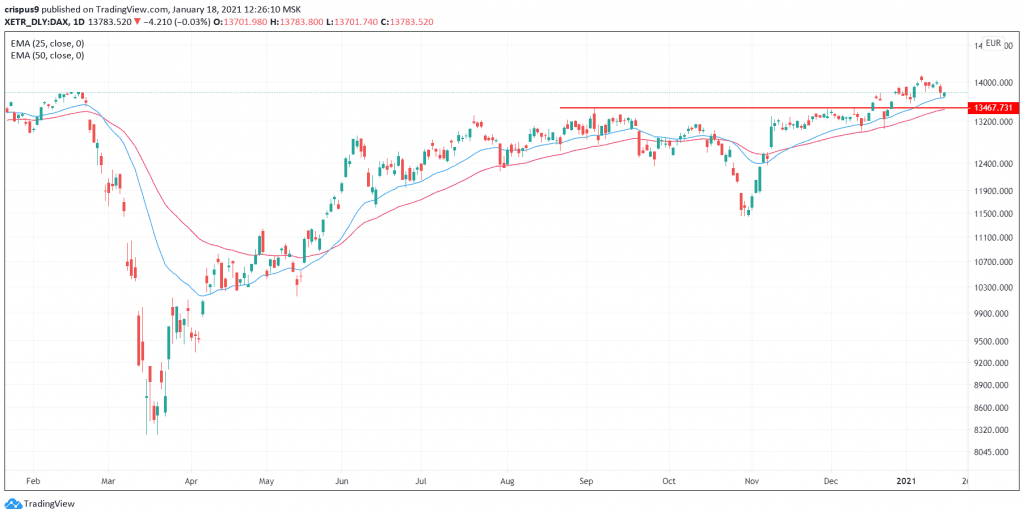

The daily chart shows that the DAX index has been under pressure in the past few days. It has fallen by almost 3% from January 8. It still remains above the important support of €13,467 and the 50-day and 25-day exponential moving averages. In my view, the current weakness is because the index recently moved above the psychological level of €14,000. Therefore, I believe that the upward trend will resume in due course.